- Community Home

- Get Support

- How can points be applied towards plan payments ?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Subscribe

- Mute

- Printer Friendly Page

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-09-2022 12:20 PM

How can points be applied to plan payment ? Have switched my seldom used $10 plan to the new point system but can't figure out how to apply the points towards my plan payment.

Solved! Go to Solution.

- Labels:

-

Payment

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-08-2022 01:42 PM

Thanks. That's what I'm looking for!

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-17-2022 12:11 PM - edited 02-17-2022 12:21 PM

@hTideGnow wrote:

@CountyDownIeUk wrote:

@BEER wrote:Are taxes charged when points are used to make plan payment?

The 15 points convert to $15 and moves to your balance. Any funds in your balance are considered as taxed money.

HI @CountyDownIeUk Just hope they won't change that. I think some people said it is kind of a glitch (at least Revenue Canada will see it that way) and PM might start taxing the full plan amount before applying the rewards credit

Think about this.

Employee discount..not taxed

Use of some but not all coupons......not taxed

Item on sale....reduction....not taxed

Negotiated savings....not taxed

Oaken sends me a box of chocolates every Christmas and a $5 coffee card for my birthday...not taxed.

Old PM rewards....not taxed

PM freebies and promos....not taxed

When your employer gives you free electricity to charge your car......not taxed or charged a fee

When your employer provides electricity for your block heater.....not taxed and no fee

Most second hand purchases.....not taxed

CRA....would be wise to leave this stuff alone and do something with the tax cheats and evaders.

If PM gives us a ”gift” they only use dollars to complete the transaction

There is the odd transaction that you will be charged and taxed in full and then the reduction is applied (and the corresponding tax is NOT refunded)

Were you not or or are you not on the old rewards program?

🥴🥴oh, just a minute I just received a T15PM tax slip in the mail😀😀

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-17-2022 11:59 AM

@CountyDownIeUk wrote:

@BEER wrote:Are taxes charged when points are used to make plan payment?

The 15 points convert to $15 and moves to your balance. Any funds in your balance are considered as taxed money.

HI @CountyDownIeUk Just hope they won't change that. I think some people said it is kind of a glitch (at least Revenue Canada will see it that way) and PM might start taxing the full plan amount before applying the rewards credit

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-17-2022 11:57 AM

@BEER wrote:Are taxes charged when points are used to make plan payment?

The 15 points convert to $15 and moves to your balance. Any funds in your balance are considered as taxed money.

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-16-2022 09:15 PM

Points are applied same as rewards. Rewards are applied and then whatever is remaining is taxed.

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-16-2022 08:56 PM

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-16-2022 08:55 PM

HI @BEER You are on the new Rewards system? if so, this is a question you can answer us this months LoL

I think they haven't change the payment system. So, I expect if you earned 15 points and converted that to $15 bill credit, they would deposit the $15 as Available Fund. When plan renewal comes, they should deduct the $15 form Plan amount and charge only that. So, if you are on $25 plan, they should just charge $10 + tax.. I think

Please tell us on your first point redemption and payment after that. thanks

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-16-2022 08:48 PM

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-16-2022 08:48 PM

Hi @BEER

No tax on any rewards,

All earned Rewards are applied to your account on your plan renewal date, before your payment is processed.

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-16-2022 08:42 PM - edited 02-16-2022 08:42 PM

I am not on the point system, but I expect points to reduce $ first and before charging tax just like now with the old reward system.

______________________________________________________________________

I am not a mod. Do not send me private message with your personal info.

If you need to contact PM Customer Support Agent, send a Private Message.

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-16-2022 08:40 PM

Are taxes charged when points are used to make plan payment?

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-09-2022 12:50 PM - edited 02-09-2022 12:52 PM

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-09-2022 12:46 PM - edited 02-09-2022 12:48 PM

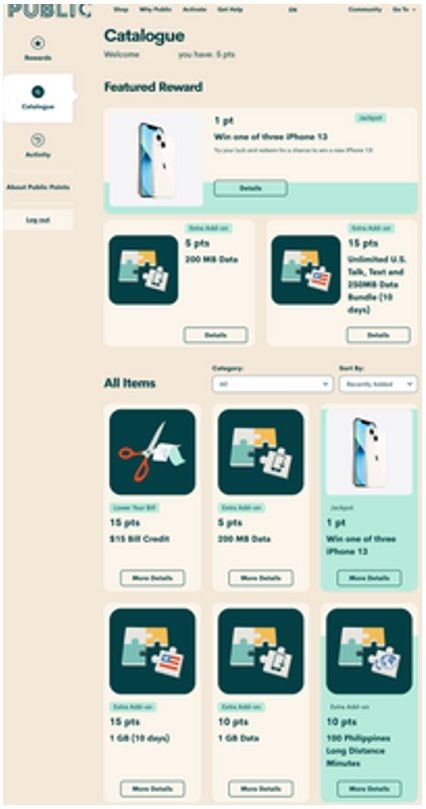

The help article, also found in @VIP_Tech post, has a nonfunctioning link.

It would be nice if they could activate that. 🙂

EDIT: well there is this, of course: https://www.publicmobile.ca/en/on/get-help/articles/Public-Points-Catalogue

But I liked @softech screen shot better with more visuals...but it was fuzzy.

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-09-2022 12:45 PM

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-09-2022 12:36 PM

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-09-2022 12:32 PM

@esjliv haha.. I changed to Public Point.. I LOVE IT!!!!

J/k.. who would? I am staying with the old system till they literally kick me off

Someone nice and posted the catalogue page once and I saved it 🙂

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-09-2022 12:30 PM

@softech - where do you find that catalogue? Do you have to be in the Public Points system to see it?

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

02-09-2022 12:21 PM - edited 02-09-2022 12:30 PM

@BEER You have to cumulate to 15 points ,then head to the Catalogue page and use your 15 points to "buy" the "$15 bill Credit"