- Community Home

- Get Support

- Re: Public Mobile Doesn't Calculate Taxes Correctl...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Subscribe

- Mute

- Printer Friendly Page

Public Mobile Doesn't Calculate Taxes Correctly

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

10-25-2022 06:41 PM - edited 10-25-2022 06:42 PM

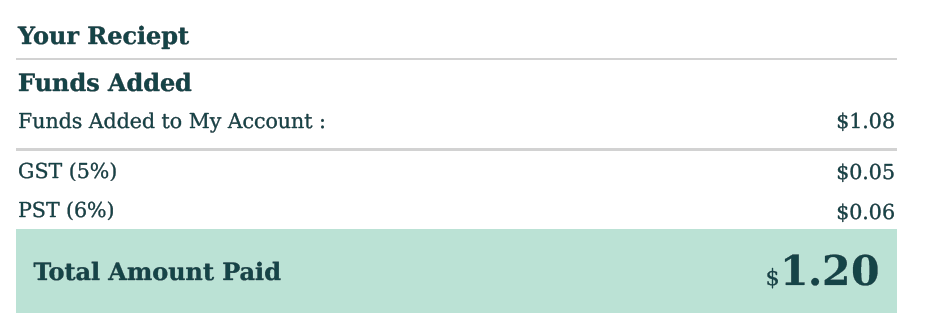

Anyone else notice that Public Mobile doesn't calculate taxes correctly? I tested this with a small payment to my account:

Big fat rounding error here... As we can clearly see, 1.08 + 0.05 + 0.06 should equal $1.19, not $1.20.

PST/GST should be rounded separately before adding: You only get 1.20 if you round by adding PST+GST and then round .. 1.08 x 1.11 = 1.1988 (Which would then round up to $1.20, which is incorrect). Indeed credit card transaction history also shows a $1.20 transaction, not $1.19, so it's not just cosmetic.

Anyhow...Not a factor for GST and HST only provinces/territories, but technically Public Mobile is pocketing a penny here and there.... Seems petty to open a ticket to report this but it bugs me when big companies fail at basic accounting. I wonder if this is also an issue for Auto-Pay?

- Labels:

-

My Account

-

Payment

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

10-26-2022 11:03 AM

So, the line item calculation is in fact worse

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

10-25-2022 08:31 PM

Interesting corroboration from Shopify.

https://help.shopify.com/en/manual/taxes/canada/canada-tax-manage#tax-rounding

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

10-25-2022 08:04 PM

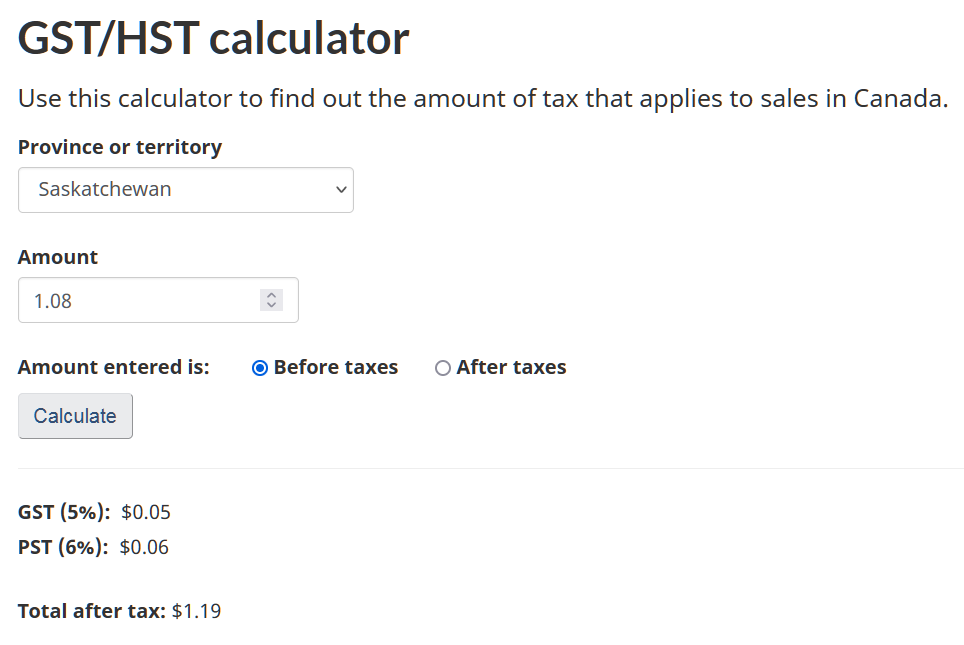

Each tax should be rounded to the nearest cent before adding them together.

PM is adding them together, then rounding to the nearest cent once, which can result in a rounding error (and does as per my example)

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

10-25-2022 07:59 PM - edited 10-25-2022 08:01 PM

The question is, each tax supposed rounded to 2 points and then added? Perhaps the software is sloppy?

Some items in BC only have 1 tax and would be rounded accordingly.

1.774 = 1.77

1.775 = 1.78.

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

10-25-2022 07:51 PM

I'm not seeing the problem either

1.08 * .05 = .054

1.08 * .06 = .0648

.054 + .0648 = .1188

1.08 + .1188 = 1.1988 round to the 10's = 1.20

1.08 * .11 = .1188

1.08 + .1188 = 1.1988

1.08 * 1.11 = 1.1988

So it's an interesting reference that the government site strips the other digits.

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

10-25-2022 07:51 PM - edited 10-25-2022 07:51 PM

PM is INCORRECT!

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

10-25-2022 07:49 PM

Here is what PM did...$1.08 + (6% + 5% = 11%) = $1.1988 or $1.20.

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

10-25-2022 07:45 PM

BC had GST and PST then to the infamous HST and we voted it (HST) out. We are back to GST and PST side by side. Not sure ant more but it is possible that some provinces charge PST on the GST amount. But never the less the example given....the addition is incorrect.

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

10-25-2022 07:37 PM - edited 10-25-2022 07:39 PM

Ok, my small business is collecting and remitting BC PST and GST, and you got me going for a second there - it sounded like I missed a major memo of updated information in the past four weeks...

The link you posted is providing HST information from 2010... BC has gone back to separate PST and GST in spring 2013. Oh, and general BC PST being 7%, HST would be 12% and not 11%...

My accounting program is calculating both sales taxes separately and if there's any rounding, it happens at the final sum. I'm not an accountant but that's how I understand the rules?

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

10-25-2022 07:29 PM

HI @Nezgar Look like you are right

But I guess even break it down into GST/PST separately, it depends on the decimal place to round off

Let us know if you are going to open ticket with PM and let us know what they say 🙂

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

10-25-2022 07:29 PM

@hTideGnow wrote:HI @Nezgar this is what I understand for Ontario and BC. It is replaced by HST (13% and 11%)

Retails are ok to simply tax it by 11% and 13% instead of breaking it into 2 separate calculations.

True you must not separately report federal & provincial parts for provinces that use HST, but I'm in a province with separate GST/PST. The article linked from 2010 includes British Columbia back during their brief time with HST - they're back to separate GST/PST since then.

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

10-25-2022 07:02 PM

So supposedly this is an "official" Government of Canada sales tax calculator, and it returns $1.19 as well: https://www.canada.ca/en/revenue-agency/services/tax/businesses/topics/gst-hst-businesses/charge-col...

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

10-25-2022 07:00 PM

HI @Nezgar this is what I understand for Ontario and BC. It is replaced by HST (13% and 11%)

Retails are ok to simply tax it by 11% and 13% instead of breaking it into 2 separate calculations.

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

10-25-2022 06:57 PM

@hTideGnow wrote:I think the guildline from Taxation Canada now is to calculate the tax rate as a total rate when they collect from customers, that's why it is using the term HST now. So, a calculation of $1.08 * 1.11 is the correct way

Oh really? I have some research to confirm if I've had the wrong understanding of this all along.

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

10-25-2022 06:55 PM - edited 10-25-2022 06:57 PM

HI @Nezgar I think the guildline from Taxation Canada now is to calculate the tax rate as a total rate when they collect from customers, that's why it is using the term HST now for BC and Ontario (sorry, not sure about the situation for other provinces) So, a calculation of $1.08 * 1.11 is the correct way under HST

It is only for reporting purpose they break it down in to GST and PST for the customers