- Community Home

- Get Support

- Re: Taxes not added in payment history?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Subscribe

- Mute

- Printer Friendly Page

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-13-2019 05:38 PM - edited 01-05-2022 06:28 AM

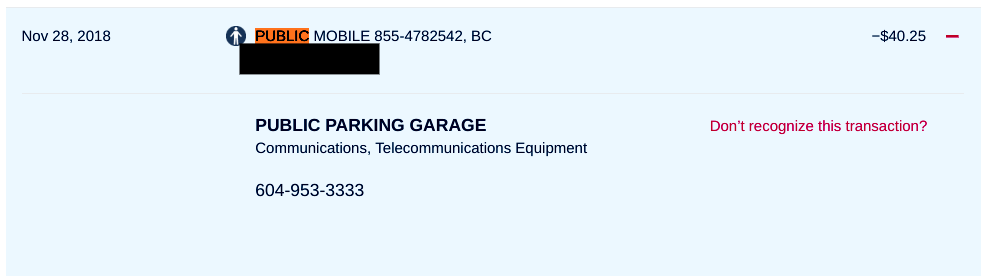

Does Public Mobile not show taxes in their payment history or did I get overcharged? My Province (NL) has 15% taxes so $35 + taxes would be $40.25 but thats not reported in my payment history.

My January bill was free due to rewards. Wondering if my next bill for February will be charged taxes during autopay?

Also... Public Mobile are classified as a parking garage by my credit card company (CIBC VISA) lol

Solved! Go to Solution.

- Labels:

-

Payment

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-13-2019 06:06 PM

@Tav wrote:

@Tav wrote:

@Lieux wrote:That's true the taxes are not shown on your payment review....but we have to pay them!!!!

No taxes were applied for January as my rewards covered the estimated payment (no taxes showing there either). Wondering if I top up my estimated payment to the amount it says before the autopay system kicks in will it not charge me taxes? This is kind of what happened last month with all the rewards covering the estimated payment.

Just tried to top up the $16 estimated for my upcoming bill and it indeed adds the tax there of $2.40 to charge me $18.40 (thought I found a way to cheat the system of taxes and save a few more bucks a month lol).

It makes sense and its not a big deal to me but that discrepancy should be showing in the payment history shouldn't it?

Where exactly?

Screen shot? (without your personal information, obviously...)

You can buy vouchers at recharge.com. Because they are not located in Canada they don't charge taxes. However, the rates fluctuate with the exchange rate and there is a processing fee.

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-13-2019 06:06 PM

I love your story with piggy @wetcoaster....![]()

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-13-2019 06:03 PM - edited 01-15-2019 01:04 AM

@Tav wrote:

@Lieux wrote:That's true the taxes are not shown on your payment review....but we have to pay them!!!!

No taxes were applied for January as my rewards covered the estimated payment (no taxes showing there either). Wondering if I top up my estimated payment to the amount it says before the autopay system kicks in will it not charge me taxes? This is kind of what happened last month with all the rewards covering the estimated payment.

Ok, lets try to explain that from a different angle...

The available funds are chips that you buy at face value+tax and put into the piggy bank.

The night before renewal the Public Mobile system converts your rewards (if applicable) into chips. It checks if you have enough chips. You might have some left over from last payment, you might have paid into the piggy bank a couple of days ago. If there are enough chips to cover the renewal cost, nothing will happen at this point. If you don't have enough chips in your piggy bank, the system gets the missing amount by buying the chips with your credit card at face value + tax. (If you don't have auto pay enabled the system is unable to top up the chips.)

Later in the night the system grabs the right amount of chips out of your piggy bank and renews your plan. If there are not enough chips in the piggy bank the renewal is not happening and your services stop working.

Edited to add*:

The transaction history in the self serve account is keeping track of the chips. Credits are putting chips into the piggy bank, debits is the system taking chips out of the piggy bank for renewal or payment for an add-on. Both, credits and debits, are broken down to the single transaction type.

* Added for completeness in one post, since this might be used for future refernce... 😉

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-13-2019 05:56 PM

@Tav wrote:

@Lieux wrote:That's true the taxes are not shown on your payment review....but we have to pay them!!!!

No taxes were applied for January as my rewards covered the estimated payment (no taxes showing there either). Wondering if I top up my estimated payment to the amount it says before the autopay system kicks in will it not charge me taxes? This is kind of what happened last month with all the rewards covering the estimated payment.

Just tried to top up the $16 estimated for my upcoming bill and it indeed adds the tax there of $2.40 to charge me $18.40 (thought I found a way to cheat the system of taxes and save a few more bucks a month lol).

It makes sense and its not a big deal to me but that discrepancy should be showing in the payment history shouldn't it?

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-13-2019 05:48 PM

@Lieux wrote:That's true the taxes are not shown on your payment review....but we have to pay them!!!!

No taxes were applied for January as my rewards covered the estimated payment (no taxes showing there either). Wondering if I top up my estimated payment to the amount it says before the autopay system kicks in will it not charge me taxes? This is kind of what happened last month with all the rewards covering the estimated payment.

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-13-2019 05:45 PM - edited 01-13-2019 05:47 PM

@Tav wrote:Does Public Mobile not show taxes in their payment history or did I get overcharged? My Province (NL) has 15% taxes so $35 + taxes would be $40.25 but thats not reported in my payment history.

My January bill was free due to rewards. Wondering if my next bill for February will be charged taxes during autopay?

Also... Public Mobile are classified as a parking garage by my credit card company (CIBC VISA) lol

Taxes are added "at point of sale", so if you add, say, $40 to your available funds, $40 will be available to be used towards your plan cost etc. But your credit card statement will be $40+tax. Same if you buy a voucher from a merchant. They will charge you the face value (amount that will be applied to your available funds) + tax.

The payment history is keeping track of the available funds, rewards and plan costs, not your actual after-tax-payments.

Your credit card company is doing that "garage" classifying. Mine says simply "Public Mobile".

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-13-2019 05:41 PM

That's true the taxes are not shown on your payment review....but we have to pay them!!!!

- « Previous

-

- 1

- 2

- Next »