- Community Home

- Get Support

- Re: More amount charged

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Subscribe

- Mute

- Printer Friendly Page

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-25-2019 04:25 PM - edited 01-05-2022 05:34 AM

Hello,

I have $25 plan. I have $5 rewards ($2 with autorecharge and $3 with friend referral). Last text message before monthly payment from Public Mobile, mentioned $20 to pay. However, in reality, $23 were charged to my credit card. But when I see my public mobile payment history, it is showing $20 charged on credit card.

I dont understand this discrepency between amount shown and amount charged. Does anyone have a thougth on it?

Thanks

Solved! Go to Solution.

- Labels:

-

My Account

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

10-02-2019 02:16 PM

@GinYVR wrote:@mc93Public Mobile calculates your taxes based on the address you had registered with.

@GinYVR wrote:@mc93Yes the tax rate should change when you change your payment address.

@GinYVR actually NO. It was confirmed for us a long time ago that tax rate is determined by your area code, not your payment address.

>>> ALERT: I am not a moderator. For account or activation assistance, please click here.

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

10-02-2019 04:14 AM

@mc93 wrote:All good 🙂

It's late, perhaps I was being a bit sensitive; I read the thread and just noticed that a lot of people responded to the question like it was about doing the math, which for the original poster it perhaps was. That's not really what I was asking about, but then maybe I should have made a new thread!

I have it figured out now, and thanks for replying!

Your welcome and yes it's often a good idea to ask your own question so that the suggestions get tailored to your unique situation. Otherwise threads can get a little confusing and when you happen upon the solution you can mark it as such. Unfortunately you got the tail end of a lively discussion on taxation when really you only wanted a clarification in regards to your account and billing. All water under the bridge now. Have a good night.

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

10-02-2019 02:52 AM

All good 🙂

It's late, perhaps I was being a bit sensitive; I read the thread and just noticed that a lot of people responded to the question like it was about doing the math, which for the original poster it perhaps was. That's not really what I was asking about, but then maybe I should have made a new thread!

I have it figured out now, and thanks for replying!

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

10-02-2019 02:39 AM

@mc93 wrote:Thanks, I think.

I was just looking for where I can see how Public Mobile is calculating things, so I can compare my numbers to theirs. Most people like to check their bills for accuracy, and that's not quick and easy or straightforward when the information you're given isn't complete and easy to read. It would be nice if their payment page included the actual payment information, but it doesn't.

Yes, it is simple math, and no, I actually didn't know the tax rate here because I moved from another province and haven't actually checked what the sales tax rate is. The link that Public Mobile gives to see the tax rates only gives GST/HST, not PST, and when I glanced at it I misread it, so was using the wrong numbers.

People will find answers more helpful if they just include information, not judgement. There is no need to put people down for asking for help.

@mc93 I apologize if my comments came across that way it was not my intention. I usually get a laugh when I make the smartphone/smart brain comment. And I suppose after waiting out the 4th lock out session of the day helping a friend activate her account I may have been a little hmmm... sarcastic? I enjoy helping others and I wouldn't want you to feel that I or anyone else would purposely "put you down". I myself have felt slighted once before and chalked it up to a learning experience but that is no excuse if my attempt at humour hurt your feelings. Once again I'm sorry and I hope this does not deter you from participating in the community.

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

10-02-2019 02:37 AM - edited 10-02-2019 02:38 AM

@mc93Yes the tax rate should change when you change your payment address. You could verify it by doing a one time manual payment after your change. The Taxes will be extra will be displayed before you submit payment.

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

10-02-2019 02:33 AM

I never would have thought of that. So will it use the correct tax rate if the payment address is updated?

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

10-02-2019 02:29 AM - edited 10-02-2019 02:29 AM

@mc93Public Mobile calculates your taxes based on the address you had registered with. (They don't do hard credit checks so they can't actually verify the info, eg after you moved etc). If you had moved from 1 province to another, updated the account just by number transfer to another province, the taxes are still calculated based on your original registration / payment address. That might explain your discrepency.

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

10-02-2019 02:22 AM

Thanks, I think.

I was just looking for where I can see how Public Mobile is calculating things, so I can compare my numbers to theirs. Most people like to check their bills for accuracy, and that's not quick and easy or straightforward when the information you're given isn't complete and easy to read. It would be nice if their payment page included the actual payment information, but it doesn't.

Yes, it is simple math, and no, I actually didn't know the tax rate here because I moved from another province and haven't actually checked what the sales tax rate is. The link that Public Mobile gives to see the tax rates only gives GST/HST, not PST, and when I glanced at it I misread it, so was using the wrong numbers.

People will find answers more helpful if they just include information, not judgement. There is no need to put people down for asking for help.

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

10-01-2019 11:05 PM

@mc93 when you log into your account and go to the payment page the bottom you will see choose the province to see your applicable taxes it will do the calculation for you. But really this is very simple math surely you know what the provincial tax rate is in your own province in BC it's 12% 7% provincial sales tax 5% GST so if your plan is $40 it comes out to $44.80. This is the problem with smartphones because everyone's brain has become stupid. This is why for years I've had a flip phone because I like to have a smart brain and a stupid phone.

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

10-01-2019 10:54 PM

@mc93 wrote:I am having a similar problem. I calculated with taxes but that doesn't actually match the amount on my credit card. How can I see that calculation?

So how much is your plan ? How much were you charged ? What province you in ?

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

10-01-2019 10:46 PM

I am having a similar problem. I calculated with taxes but that doesn't actually match the amount on my credit card. How can I see that calculation?

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

07-04-2019 11:20 PM

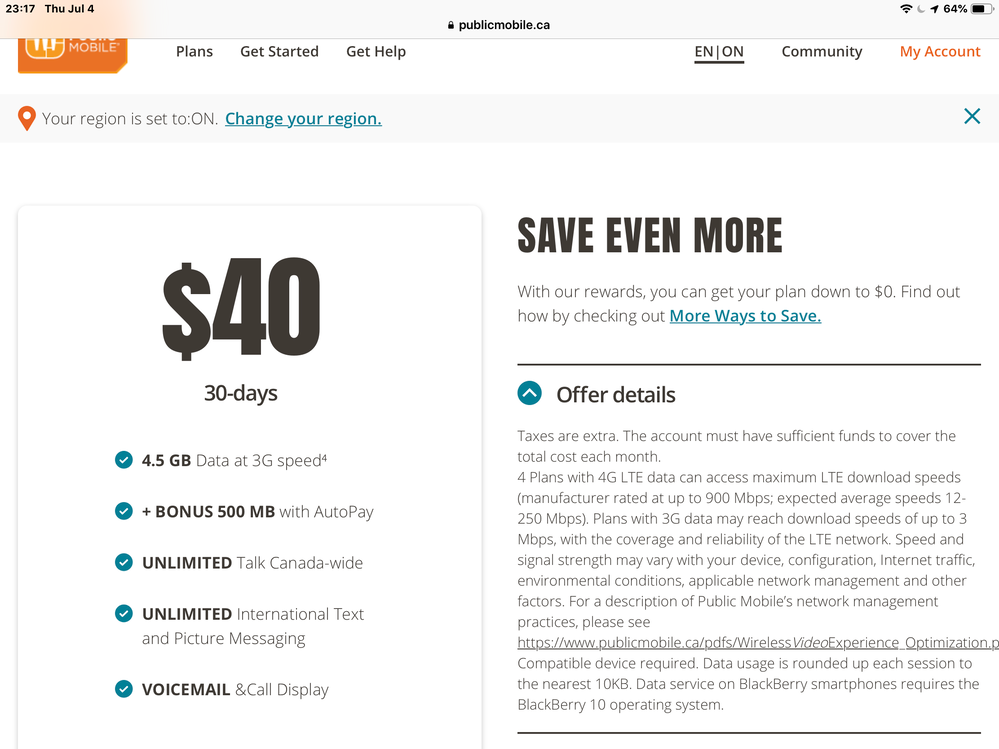

I see tight here on a currently featured plan, in the offer details. Taxes are extra.Public Mobile is not hiding this.

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

07-04-2019 12:31 AM

@naluukti wrote:

"You must let your customers know if the GST/HST is being applied to their purchases. You can use cash register receipts, invoices, contracts, or post signs at your place of business to inform your customers whether the GST/HST is included in the price, or added separately. You have to show the GST/HST rate that applies to the supply. Also, you have to either show the amount paid or payable for the supply separately from the amount of GST/HST payable on the supply or show that the total amount paid or payable for a supply includes the GST/HST."

@naluukti that appears to be geared toward brick and mortar purchases, since it's talking about signage at your place of business. I would presume Telus has done their due diligence in terms of knowing what they are obligated to provide and not provide, but if you're concerned, I would suggest you make a complaint to CRA and ask them to investigate.

>>> ALERT: I am not a moderator. For account or activation assistance, please click here.

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

07-03-2019 11:50 PM

I had a look back at some online purchases I've made. Would you think the CRA would be interested in auditing and making sure that Amazon would have to follow all the rules? Durn tootin' they would. I see no sign of any GST number anywhere up to the last screen before saying go. The "receipt" in email afterwards???...no mention.

Same thing here. Don't you think Telus and their army of lawyers wouldn't be making sure that they're complying with the CRA and the the CRA's army of lawyers wouldn't be all over Telus? At least here you can find a GST number in the payment screen.

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

07-03-2019 11:04 PM

"You must let your customers know if the GST/HST is being applied to their purchases. You can use cash register receipts, invoices, contracts, or post signs at your place of business to inform your customers whether the GST/HST is included in the price, or added separately. You have to show the GST/HST rate that applies to the supply. Also, you have to either show the amount paid or payable for the supply separately from the amount of GST/HST payable on the supply or show that the total amount paid or payable for a supply includes the GST/HST."

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

07-03-2019 04:13 PM - edited 07-03-2019 04:14 PM

@naluukti wrote:Yes, but generally there is a receipt of some kind that shows this. In fact, I thought it was the law. Had I not stumbled across this thread I would have asked the same question (before reaching the same conclusion). Is the invoice or bill actually available anywhere for users to view?

@naluukti no. You can look at your transaction history in your self-serve account to see how the plan is billed, but this is all pre-tax. Taxes are charged on the payment. The payment is used to credit your account with the pre-tax dollars, which are then used to pay for your plan (or add-on(s), etc.). If you want a receipt which breaks down the payment amount and the tax, you will need to purchase a payment voucher and apply that to your account. The voucher print-out will show the breakdown, though it won't have anyting about your specific plan. You can find stores to purcahse a voucher here: https://www.publicmobile.ca/en/store-locator and more on your payment options here: https://www.publicmobile.ca/en/bc/get-help/articles/retail-faqs

GST registration number can be found somewhere, though I'm having a hard time locating it at this moment. Will update this reply shortly if/when I find it. 🙂

EDIT: found it. It's on the Make a Payment page https://selfserve.publicmobile.ca/Overview/payment/Make-a-Payment/. You don't actually have to make the payment, just loading the page will show you the GST number, and you can navigate away or close the browser tab.

>>> ALERT: I am not a moderator. For account or activation assistance, please click here.

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

07-03-2019 03:31 AM - edited 07-03-2019 03:36 AM

@naluuktiCan you refer us to a place where a receipt of some kind is the law of the land especially for prepaid services?

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

07-02-2019 10:20 PM - edited 07-02-2019 10:21 PM

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

07-02-2019 10:09 PM

Yes, but generally there is a receipt of some kind that shows this. In fact, I thought it was the law. Had I not stumbled across this thread I would have asked the same question (before reaching the same conclusion). Is the invoice or bill actually available anywhere for users to view?

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-25-2019 04:55 PM

It never ceases to amaze me how many people get confused by this. You're in Canada--we pay taxes. On almost everything. The first time a number charged doesn't look right, I try dividing it by the combined tax rate for my province. It should take anyone seconds to figure this out the first time.

>>> ALERT: I am not a moderator. For account or activation assistance, please click here.

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-25-2019 04:29 PM

Your payment history does not show taxes only your credit card history shows full amount.

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-25-2019 04:28 PM

@Kirantod wrote:Hello,

I have $25 plan. I have $5 rewards ($2 with autorecharge and $3 with friend referral). Last text message before monthly payment from Public Mobile, mentioned $20 to pay. However, in reality, $23 were charged to my credit card. But when I see my public mobile payment history, it is showing $20 charged on credit card.

I dont understand this discrepency between amount shown and amount charged. Does anyone have a thougth on it?

Thanks

Did you count the taxes??? With the payment on your credit card you pay the taxes. 20$+ taxes~ 23$??

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-25-2019 04:27 PM

@Kirantod wrote:Hello,

I have $25 plan. I have $5 rewards ($2 with autorecharge and $3 with friend referral). Last text message before monthly payment from Public Mobile, mentioned $20 to pay. However, in reality, $23 were charged to my credit card. But when I see my public mobile payment history, it is showing $20 charged on credit card.

I dont understand this discrepency between amount shown and amount charged. Does anyone have a thougth on it?

Thanks

@KirantodTax ? (15% tax on $20 = $23)