- Community Home

- Get Support

- Re: taxes on phone bill

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Subscribe

- Mute

- Printer Friendly Page

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-09-2021 11:01 PM - edited 01-04-2022 05:14 AM

Hello,

I currenly have the $25 plan with $5 worth of rewards that I got recently. It used to be $4 rewards.

I live in Calgary where sales tax is 5%

My bills have been $23.52 for the longest time and most recently it was $22.40

I am wondering how much tax publicmobile charges?

22.40/20 is 1.12 implying that I'm paying 12% in tax

same with 23.42/21 is also 1.12

It seems that I'm being charged 12% tax.... why?

Solved! Go to Solution.

- Labels:

-

Payment

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-10-2021 05:00 PM

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-10-2021 03:34 PM - edited 11-10-2021 03:58 PM

Johnny was supposed to have already closed that loop hole.

https://www2.gov.bc.ca/assets/gov/taxes/sales-taxes/publications/pst-321-businesses-outside-bc.pdf

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-10-2021 03:31 PM

@darlicious : With what tax rules I can find and my layperson understanding thereof, it's a...

I would maintain that these things might not want to be talked about in too much detail. I'm sure the taxing authorities are well aware of what goes on.

And @softech , if legally compelled, they'll snap to it.

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-10-2021 02:35 PM

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-10-2021 02:28 PM

@Anonymous wrote:All this detailed with proof tax talk could conceivably backfire on everyone in the long run.

Just sayin'

.. but it takes forever for PM to make a change.. even a simple bug fix. 🙂

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-10-2021 02:27 PM

All this detailed with proof tax talk could conceivably backfire on everyone in the long run.

Just sayin'

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-10-2021 02:21 PM

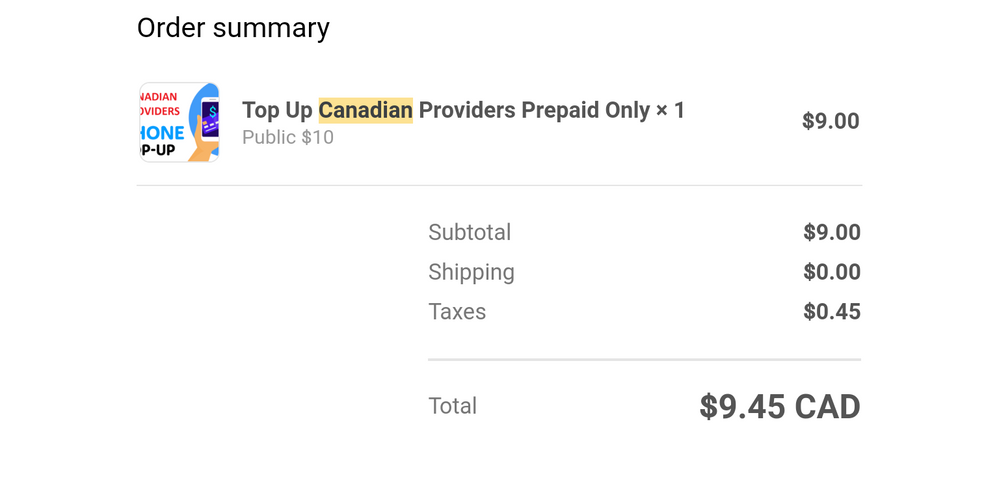

This is my reciept for a 10% off $10 voucher. When Its added to an account balance it is $10. I paid $9+5% gst=$9.45

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-10-2021 02:18 PM - edited 11-10-2021 02:23 PM

@pkaraa wrote:@darlicious that "only GST" at CCS is on top of what PM will charge you total bill which is plan charges and GST/HST.

PM will deduct the from Available fund first. Any further outstanding charge to your credit card will then be charged with full tax (GST+PST) . So, if you have voucher that you got that charged only 5% GST and fully covered your bill , then PM will not charge extra tax on top. That is the whole idea of getting a voucher from a province with last tax to save a bit from the tax difference.

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-10-2021 02:09 PM - edited 11-10-2021 02:10 PM

@darlicious that "only GST" at CCS is on top of what PM will charge you total bill which is plan charges and GST/HST.

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-10-2021 02:50 AM

You can also buy vouchers from CCS. If you live outside of Ontario they charge only gst. Use interac to avoid the surcharge. If you are lucky you will catch their true flash sale on discounted pm vouchers and save an additional 10%.

I'll go one further...buy $10 pm vouchers at London Drugs after you join their LD Extras loyalty program. For every $10 purchase per day or store you recieve a "visit". For every 10 visits you earn a $5 "coupon". These can then be used towards a purchase of a pm voucher which will earn you another "visit". This in effect saves you the gst on your pm vouchers. You also recieve a $5 coupon on your birthday.

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-10-2021 12:49 AM - edited 11-10-2021 12:53 AM

When you buy voucher in Alberta, they charge you only 5% tax

so, a $50 voucher will cost you $52.5.

When you apply the voucher on the account, the face value of the voucher, $50 , will be added as the Available Fund on your account.

So, if your plan is $50, PM will deduct the $50 off the available Fund

the same voucher would cost you $56 in BC (12% tax), $56.5 in Ontario (13%tax) and as much as $57.50 in PEI (15% tax), and when yo apply it on your account, it will still be the same $50 as Available Fund

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-10-2021 12:41 AM

question :

how would it save to buy voucher in alberta.

If PM is billing lets say $25 and 12% tax then how paying with voucher ll reduce the renewal amount.

If the total bill comes out to be $28 then voucher should be of $28 ... no?

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-09-2021 11:58 PM - edited 11-10-2021 12:02 AM

@hairbag1 wrote:

@Samaanthag wrote:account should be alberta, but i'm not sure.

phone number is a BC number.

You have a BC area code so you're taxed as a BC res at 12%.

Buy payment vouchers at Shell Gas stations in Alberta and pay 5% tax...then apply those vouchers to your account before renewal.....OR...get an Alberta phone number to reduce taxes.

Or...start up in any province and choose an Alberta number. Do some manual top ups...for future payments and buy add ons if needed. Then change your number back to your location. Not that I would do that....it will save some, a few dollars.

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-09-2021 11:58 PM

@Samaanthag wrote:good to know. that's good motivation for me to change my phone number haha. thank you!

Another option if you like to keep your non-AB phone number:

You can buy the PM topup voucher with 5% GST since you are in Calgary.

You can still get the $2 autopay reward as long as you have autopay enabled. All you need to do is to add fund in your account using voucher before your renewal day. If your account has enough available fund in your account to pay for your renewal, PM will not get fund from your autopay cc.

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-09-2021 11:44 PM

@Samaanthag wrote:account should be alberta, but i'm not sure.

phone number is a BC number.

You have a BC area code so you're taxed as a BC res at 12%.

Buy payment vouchers at Shell Gas stations in Alberta and pay 5% tax...then apply those vouchers to your account before renewal.....OR...get an Alberta phone number to reduce taxes.

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-09-2021 11:26 PM

Your BC number explains the extra tax 12% instead of Alberta 5% if you really need the BC number OR changing to AB number might save you 7% tax.

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-09-2021 11:17 PM

oh, i know where my rewards came from. i just didn't understand the tax. thank you

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-09-2021 11:12 PM

@Samaanthag wrote:good to know. that's good motivation for me to change my phone number haha. thank you!

And login to My Account and check your reward, I think you have the extra dollar off from the Loyalty. Of course, it could be another Friends referral 🙂

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-09-2021 11:11 PM

@Samaanthag wrote:account should be alberta, but i'm not sure.

phone number is a BC number.

Yes, they charge tax based on your phone number.. BC number BC tax

If you want to save a big of tax, change your number to Alberta to take advantage of the cheaper tax

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-09-2021 11:11 PM

good to know. that's good motivation for me to change my phone number haha. thank you!

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-09-2021 11:10 PM

account should be alberta, but i'm not sure.

phone number is a BC number.

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-09-2021 11:09 PM - edited 11-09-2021 11:10 PM

@Samaanthag Pre-tax amount, your plan dropped $1, look like it is because another year of loyalty reward (i think your anniversary in October)

for the tax part, what is the area code of your phone number? It looks like your number is from BC or Manitoba. PM charges tax based on where the phone number area code belongs to

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-09-2021 11:03 PM

@Samaanthag....is your account / phone number in Alberta or somewhere else ?