- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-08-2023 05:24 PM - edited 09-08-2023 05:24 PM

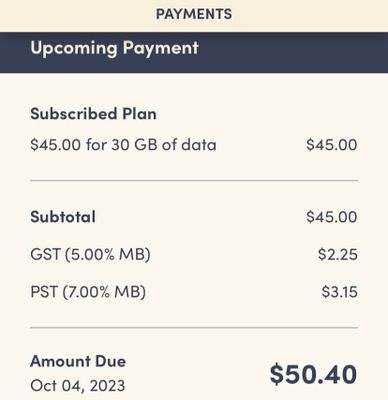

I made a Friend Referral in Alberta and she signed up while in Alberta using my Friend Referral Code.

She has now been with Public Mobile for two months and reached out asking why she's being charged Manitoba Taxes when she lives and is using this phone in Alberta.

She has a 204 phone number which I walked her through Port in during Activation, so it's not a 403 or 587 area code for Alberta.. could that be the issue?

I've asked her and given her directions to update the Address on her Account to make sure it's a AB Postal Code and Address, but she might have already tried that since I'm just waiting for a reply.

She asked me if changing her number to a new AB one would fix it, I advised her against that since you can usually keep your Number in another province without paying where you moved from Taxes, right?

Solved! Go to Solution.

- Labels:

-

My Account

-

Payment

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-08-2023 06:38 PM - edited 09-08-2023 06:41 PM

@hTideGnow I have no affiliation to Public Mobile aside from having Personal Accounts and making alot of Friend Referrals whome I assist with Activation, Port in, Account Setup and occasionally Managment to make it easier for them

Since I am not affiliated with Public Mobile and I'm a regular user just like you, I have no choice but to also use The Community for Support, Resources, and Solutions.

I'm not an Agent, I only sell Public Mobile Third Party within Winnipeg and I make it clear to everyone I sign up that I'm not an Authorized Agent but they're welcome to use me for Support if needed.

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-08-2023 06:20 PM - edited 09-08-2023 06:20 PM

thanks @dust2dust

Then I guess @Priority should keep a note of all these special cases as he is an agent and he is doing it for his business 😂. We are all just part time volunteers here. LoL

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-08-2023 06:17 PM - edited 09-08-2023 06:18 PM

@hTideGnow- I think maple_leaf found some interesting info. Signing up may very well be different from what we used to know. We have also seen people coming in complaining about invalid province or something and this might be why. (other than the stupid google problem)

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-08-2023 06:12 PM

@Priority wrote:Another thing Is I have Referrals from Alberta who Activated in Manitoba and still only paid Alberta Taxes since day 1... so I feel like it's likely her Postal Code or Address.

No @Priority , tax always based on phone number, never based on the address. So,. your your " Referrals from Alberta who Activated in Manitoba and still only paid Alberta Taxes" must have got an Alberta phone number. Or ask him to post us screenshot to verify

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-08-2023 05:39 PM

Hello @Priority , See: https://www.publicmobile.ca/en/on/get-help/articles/how-we-calculate-tax

"The tax calculation process varies at two different instances. Here's how we determine your tax rate:

1. Account activation: When creating your Public Mobile account and choosing your subscription plan, the tax rate is determined by the postal code provided in your billing address.

2. Subsequent subscription payments: After your first payment, all future payments will include a tax rate determined by your phone number’s billing address.

If your phone number’s area code and payment method’s postal codes are for the same province, you will be charged the same tax rate for all payments. If they represent different provinces, there may be a slight difference in the amount charged."

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-08-2023 05:31 PM

@Priority wrote:Another thing Is I have Referrals from Alberta who Activated in Manitoba and still only paid Alberta Taxes since day 1... so I feel like it's likely her Postal Code or Address.

That isn't correct. The only thing that matters is the phone number. If your friend wishes to pay the Albertan sales tax rate, she can purchase vouchers from a stores that carries them (in Alberta).

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-08-2023 05:29 PM

It's area code.

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-08-2023 05:28 PM - edited 09-08-2023 05:29 PM

Another thing Is I have Referrals from Alberta who Activated in Manitoba and still only paid Alberta Taxes since day 1... so I feel like it's likely her Postal Code or Address.

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-08-2023 05:28 PM - edited 09-08-2023 05:43 PM

@Priority wrote:I made a Friend Referral in Alberta and she signed up while in Alberta using my Friend Referral Code.

She has now been with Public Mobile for two months and reached out asking why she's being charged Manitoba Taxes when she lives and is using this phone in Alberta.

She has a 204 phone number which I walked her through Port in during Activation, so it's not a 403 or 587 area code for Alberta.. could that be the issue?

I've asked her and given her directions to update the Address on her Account to make sure it's a AB Postal Code and Address, but she might have already tried that since I'm just waiting for a reply.

She asked me if changing her number to a new AB one would fix it, I advised her against that since you can usually keep your Number in another province without paying where you moved from Taxes, right?

For payments in Self Serve or 611 usng a saved payment method, taxes are always based on the rate of the province of the phone number. Where she uses the service and the address on the account aren't factors.

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

09-08-2023 05:27 PM

Taxes are charged based on AREA CODE not address reported to PM.

So you can be in Ontario and have area code from lower taxes province and thus pay less $.