- Community Home

- Get Support

- Re: taxes

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Subscribe

- Mute

- Printer Friendly Page

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-05-2020 12:03 AM - edited 01-05-2022 05:23 PM

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-13-2020 07:56 PM - edited 11-13-2020 07:57 PM

Never mind, just noticed the topic is more than 1 week old.

AE_Collector

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-06-2020 02:36 AM

@Anonymous wrote:First Nations exempt after the fact.

I don't have Status. I have a friend with Status. Who is able to buy my PM Payment Vouchers for me from a vendor on native land.

So no taxes at point of payment in this situation. $40 cash buys $40 account balance.

The vendor does not sell PM SIM cards, though. Taxes still applied at point of payment. Most people will not need to purchase more than one SIM card, one-time tax loss on a $10 item isn't so bad.

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-05-2020 09:45 PM

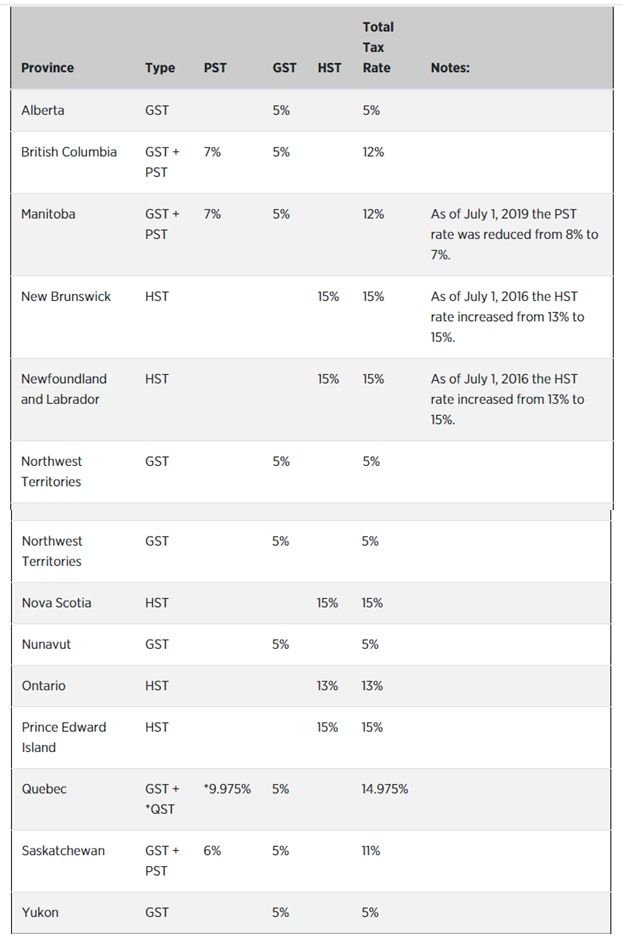

its all about where you live

BC 12%

AB 5%

ON 13%

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-05-2020 12:21 PM

@Haiggy wrote:you will see a line for tax and a total of $17.25 in NB.

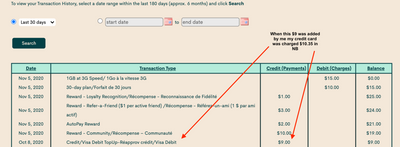

Thanks for the clarification, I just don't see the line for tax as you described. When checking my credit card statements, I see the total charge including taxes, but no line in my billing history for taxes, which is kind of misleading, no?

I think that sentence referred to doing a manual payment. There you'll see the taxes that will be charged on the payment card. But you won't see tax detail in the self-serve payment history. I like that the dollars are the even amounts and not the whole mess of taxes and all. So you just know that all those numbers are pre-tax and that tax gets charged on the method of payment.

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-05-2020 12:09 PM

@kb_mv wrote:

@Haiggy wrote:Correct me if I’m wrong, but all taxes are included with prepaid, no? I’ve always had a round dollar amount on my credits. Never a separate line for taxes.

you will see a line for tax and a total of $17.25 in NB.

Thanks for the clarification, I just don't see the line for tax as you described. When checking my credit card statements, I see the total charge including taxes, but no line in my billing history for taxes, which is kind of misleading, no?

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-05-2020 11:29 AM

@Haiggy Check you credit card statements your Public Mobile payments will/should include taxes.

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-05-2020 09:51 AM

@Haiggy wrote:I’ve had many lines with PM and been with them for over 2 years. Not one charge for taxes.

If you're not being charged taxes anywhere in all the mentioned ways then I would not talk about it. I have read here of the rare times someone wonders why they weren't being charged taxes.

Perhaps you might be noticing that carrying a balance in Available Funds and that all renewals are paid from that, that no taxes will be charged. Credits and rewards that get added to Available Funds are not taxed.

I have noticed the odd occasion of not being charged all the relevant taxes in some rare cases in stores.

But what I call "new" or real money into the account gets taxed.

Whether all of what I've just said should not be talked about...maybe. 🙂

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-05-2020 08:14 AM - edited 11-05-2020 02:54 PM

@Haiggy wrote:Correct me if I’m wrong, but all taxes are included with prepaid, no? I’ve always had a round dollar amount on my credits. Never a separate line for taxes.

@Haiggy Prepaid has never meant that taxes are already in the price. The issue that you speak of about being undercharged usually only happens during activation for the first payment.

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-05-2020 08:11 AM

@Haiggy Maybe this pic will help/ I just renewed today. Last month on 8 Oct I added a manual payment of $9. I was credited with $9 of available funds but that cost me $10.35 with tax in NB.

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-05-2020 07:58 AM

@Haiggy wrote:I’ve had many lines with PM and been with them for over 2 years. Not one charge for taxes.

@Haiggy Respectfully you are either mistaken or very lucky. You will not see a charge for taxes on your payment history in your self serve. That is because the taxes have already been charged when you loaded up your available funds as I explained in my post. How do you pay? If it is autopay, let's see a screenshot of your credit card charge without any personal details. If you pay by voucher then the store that you buy it at charges you tax.

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-05-2020 07:49 AM

I’ve had many lines with PM and been with them for over 2 years. Not one charge for taxes.

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-05-2020 07:48 AM

@Haiggy wrote:Correct me if I’m wrong, but all taxes are included with prepaid, no? I’ve always had a round dollar amount on my credits. Never a separate line for taxes.

@Haiggy You are not correct. Your credits do not show taxes, but when you put the credits there, as others have said, through a voucher, manual payment or autopay, taxes are charged. If you buy a $15 voucher to add, you are charged $17.25 in NB. If you go into your self serve account and add $15 to your available funds, you will see a line for tax and a total of $17.25 in NB. If you leave it up to autopay, your credit card is charged $15 plus tax for a total of $17.25 in NB and then the $15 are added to your available funds and used to pay your $15 bill.

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-05-2020 07:40 AM

Correct me if I’m wrong, but all taxes are included with prepaid, no? I’ve always had a round dollar amount on my credits. Never a separate line for taxes.

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-05-2020 01:14 AM - edited 11-05-2020 01:14 AM

@davinderkaur $40 - $2 (Auto-Pay credit) = $38 plus tax.

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-05-2020 12:29 AM - edited 11-05-2020 12:30 AM

@davinderkaur wrote:if i activate $40 plans how much i pay after taxes

Hi @davinderkaur depends on where you live. There are three types of sales taxes in Canada: PST, GST and HST. See below for an overview of sales tax amounts for each province and territory. https://www.retailcouncil.org/resources/quick-facts/sales-tax-rates-by-province/

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-05-2020 12:13 AM - edited 11-05-2020 12:14 AM

@davinderkaur wrote:if i activate $40 plans how much i pay after taxes

Taxes depends on the area code of your phone number.

If you have AB area code phone number, you pay 5% GST even if you are living on ON with 13% HST.

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-05-2020 12:06 AM

@davinderkaur wrote:if i activate $40 plans how much i pay after taxes

Which province are you in? If the tax rate there is 13%, the $45.20. If you're in a place with a 15% sales tax rate, the total would be $46.00.

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-05-2020 12:05 AM - edited 11-05-2020 12:09 AM

@davinderkaur wrote:if i activate $40 plans how much i pay after taxes

Federal GST 5%

Provincial varies

First Nations exempt after the fact

Edit: the self-serve shows all before tax. You pay taxes at the "place" of purchase. ie. in a store for a voucher, in a store for instant top-up, the payment card used in the self-serve. A manual payment in the self-serve will show you your taxes.

Taxes are based on the area code of the province that your number belongs to.