- Community Home

- Get Support

- mbna Rewards World Elite Mastercard payment

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Subscribe

- Mute

- Printer Friendly Page

mbna Rewards World Elite Mastercard payment

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-17-2024

02:26 PM

- last edited on

01-17-2024

05:00 PM

by

computergeek541

![]()

I use Mbna Rewards World Elite Mastercard pay my phone bill. it should have 5 time point rewards for any phone bill.

But my public mobile monthly payment only get 1 time point reward. they said the reason is public mobile catalog themselves as "phone device" code "4812"(MasterCard define the code catalog and merchant select from it). they should change their catalog as "phone service" 4814.

Any suggestion of this?

Thanks

Helen

- Labels:

-

Payment

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-17-2024 08:48 PM

I know they pass it on to the consumers in the prices. I'm fine with that. I'm saying that I don't want to see it as a separate charge. I will not pay it. And that's why I will and do walk out of stores such as your that practice this. You are most welcome to do it, don't get me wrong, but I will not pay it. There are other establishments I can go to @wetcoaster .

@DennyCrane , @Handy1 @hTideGnow

But on a different note, I called my bank and after alot of talking and escalation, I got a one time $20 bill credit to make up for the 1%.

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-17-2024 06:44 PM

@Handy1 Yeah, and whether they waive the fee or not doesn't change whether or not it's a premium card or not.

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-17-2024 06:44 PM

@Sansan Premium cards tend to have very rich travel, insurance, points, and/or lounge access etc. There are lots of fee cards that offer basic points or insurance, or maybe a discounted interest rate, that are not considered premium cards.

I don't have a list of all the premium cards out there, buty understanding is they are more the exception than the norm.

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-17-2024 06:27 PM

@Sansan @DennyCrane Also if with the same bank you have enough products they waive these fees along with the banning fees each month . They charge it and re credit it and give you a safety delist box to make you feel important

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-17-2024 06:24 PM

That is what I meant. However, how can a card that has an annul fee not be premium? That's why they come with travel benefits, added travel insurance, insurance under 65 , mortgage redemptions to name a few. Basic cards don't have these.

The difference is that most banks waive the annual fee for the first year but that's still premium.

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-17-2024 06:17 PM

@Sansan wrote:No, that is actually not correct. A premium visa card that has an annual fee, does pay a higher merchant fee than a basic card that does not have an annual fee from the same bank.

I know this for a fact. I have 2 cards from the same bank 1 with fee and 1 without and there is a higher fee to the merchant whenever I use the card in their establishment.

Yes and no. It's not necessarily whether the card has a fee (to the customer) or some sort of rewards program that determines that, it's whether or not the card is deemed to be a premium card. Not all fee cards are premium cards (most aren't).

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-17-2024 06:14 PM

No, that is actually not correct. A premium visa card that has an annual fee, does pay a higher merchant fee than a basic card that does not have an annual fee from the same bank.

I know this for a fact. I have 2 cards from the same bank 1 with fee and 1 without and there is a higher fee to the merchant whenever I use the card in their establishment.

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-17-2024 06:03 PM

@Handy1 wrote:Because there not enough Ativan in the world to get me in a plane so travel is out if the question for me

🤣🤣🤣🤣🤣

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-17-2024 05:58 PM - edited 01-17-2024 06:00 PM

@DennyCrane Yes 1-2% but on all spending i usually wait until they have offers on redeeming the points towards mortgage or rrsp . Because there not enough Ativan in the world to get me in a plane so travel is out if the question for me

adding when they have the sales 8-10 thousand points you can get $100 cash back for but you get your best value on flights

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-17-2024 05:55 PM - edited 01-17-2024 05:56 PM

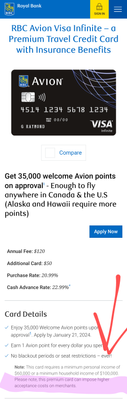

@Handy1 I think the Avion card is just 1%, and then a bit more on travel purchases, right? I don't believe they have any sort of utility or grocery bonus.

I actually just responded to a pre approval offer for it yesterday. I'm only keeping it for the free year they offered me, because it comes with a welcome bonus that's enough for a free flight. But I don't think the point value is as good as people make it out to be. AMEX Cobalt is my favourite.

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-17-2024 05:52 PM

@DennyCrane That’s the credit card I have and it earns points also but not with PM . So I wonder and asked on my first reply if buying vouchers with it would give me those points instead and just leave auto pay on and top up with vouchers

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-17-2024 05:50 PM

@hTideGnow There are actually "premium" credit cards that charge the merchants more to accept.

https://www.clearlypayments.com/blog/most-expensive-credit-cards-for-merchants

https://www.rbcroyalbank.com/credit-cards/travel/rbc-avion-visa-infinite.html

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-17-2024 05:45 PM - edited 01-17-2024 05:46 PM

@Sansan wrote:

The premium cards fees are more than the basic cards fees. If they agree to it, they should not be avoid or finding a loop hole as to why they are not honoring the perks that the cc offers. Another such avoidance instead of refusing the cc flat out is the charge $.25 if your purchase is under $5.00 or whatever their 'minimum' amounts are. This is actually illegal.

hi @Sansan

if you meant a mechant needs to pay higher fess for a Cash Back/rewards card than someone pay with a basic card of the same brand, then it is Untrue.

Merchant pay the same charges no matter what card you use, only difference will be the type of cards. So, they might pay different charges for Visa/MC/AMEX (hence many merchants avoid AMEX). But a basic Visa card charge is the same as one Platinum Visa with perks , or a Bank A Visa and a Brank B Visa would be no different to the merchant

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-17-2024 05:41 PM

@Sansan wrote:I fully agree with you. The merchants do sign a contract with both Visa and Mastcercard International with the fee % that they are to pay for accepting debit and credit cards.

The premium cards fees are more than the basic cards fees. If they agree to it, they should not be avoid or finding a loop hole as to why they are not honoring the perks that the cc offers. Another such avoidance instead of refusing the cc flat out is the charge $.25 if your purchase is under $5.00 or whatever their 'minimum' amounts are. This is actually illegal.

I've looked into it. But rather than argue and make a scene (I used to) lol at the store that practice this, I don't shop there anymore. I'm a credit card junkie. I use it strictly for the benefits and not because I have to.

I know it was announced sometime last year that the government approved allowing merchants to start charging customers a surcharge for using credit cards to offset their fees. I have not encountered that yet, but the day I do and the store that does that will no longer be seeing me there again.

I might be just 1 person and won't make a difference, but not me.

Not shopping where you get charged for using your credit cards? You really think that you are not paying for those merchant fees? If a small merchant is not passing on the fees they are paying, they have failed business 101 - it's called overhead and will need to be worked into their product prices and/or shop rates. Otherwise they'll have to close the doors sooner rather than later.

You know, as owner of a tiny, very specialized business, should you ever walk through my door... I'm not sure if I actually want to help you with your problem, since you clearly seem unwilling to pay the percentage of overhead that it takes to accommodate your needs.

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-17-2024 05:37 PM

@hTideGnow wrote:HI @DennyCrane

i always suspect it has to do with charge and process

I think for Pre-authorized payment, the system needs to connect to the credit card payment and flag it, which I doubt PM system does that

also, there is definitely higher charges for the merchant (as it gives them the certainty that payment will be received) and I think PM , a 3rd tier not willing to pay the extra

Even some other very large companies do not classify payments as recurring. Netflix is a very good example of one.

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-17-2024 05:34 PM

HI @DennyCrane

i always suspect it has to do with charge and process

I think for Pre-authorized payment, the system needs to connect to the credit card payment and flag it, which I doubt PM system does that

also, there is definitely higher charges for the merchant (as it gives them the certainty that payment will be received) and I think PM , a 3rd tier not willing to pay the extra

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-17-2024 05:30 PM

For sure, but at the end of the day they don't get the final say. There are criteria for each. It's just like I don't get extra cash back at WalMart because it's not primarily a grocery store. That MBNA card says "home utilities" as a recurring payment, which for whatever reason PM is not designated as.

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-17-2024 05:28 PM

thanks @DennyCrane for the link

I think they can at least request:

Businesses cannot assign their own MCC codes but can request a specific MCC designation from their payments processor

But it says different card can have different codes, so "phone service" "4814" might not be the code for all CC?

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-17-2024 05:23 PM

Businesses don't get to pick their merchant category.

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-17-2024 05:06 PM - edited 01-17-2024 05:15 PM

@Helen_C wrote:I use Mbna Rewards World Elite Mastercard pay my phone bill. it should have 5 time point rewards for any phone bill.

But my public mobile monthly payment only get 1 time point reward. they said the reason is public mobile catalog themselves as "phone device" code "4812"(MasterCard define the code catalog and merchant select from it). they should change their catalog as "phone service" 4814.

While it might seem advantageous to recieve a higher cash back or rewards point amount from MNBA, this money comes from somewhere and isn't entirely free in the sense that higher payment processing fees would eventually lead to higher plan prices from Public Mobile for everyone. For this reason, be careful what you wish for. It's may not be to any customer's advantage if Public Mobile were to classify these payments as recurring.

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-17-2024 04:39 PM

I fully agree with you. The merchants do sign a contract with both Visa and Mastcercard International with the fee % that they are to pay for accepting debit and credit cards.

The premium cards fees are more than the basic cards fees. If they agree to it, they should not be avoid or finding a loop hole as to why they are not honoring the perks that the cc offers. Another such avoidance instead of refusing the cc flat out is the charge $.25 if your purchase is under $5.00 or whatever their 'minimum' amounts are. This is actually illegal.

I've looked into it. But rather than argue and make a scene (I used to) lol at the store that practice this, I don't shop there anymore. I'm a credit card junkie. I use it strictly for the benefits and not because I have to.

I know it was announced sometime last year that the government approved allowing merchants to start charging customers a surcharge for using credit cards to offset their fees. I have not encountered that yet, but the day I do and the store that does that will no longer be seeing me there again.

I might be just 1 person and won't make a difference, but not me.

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-17-2024 04:17 PM

I can't say for sure since it's been several years now that I looked into credit card fees from the merchant side, but...

There is a possibility that Public Mobile would incur extra charges on their side when accepting these "recurring payments" from premium cards. And sticking to 30day cycle and "wrong" code might be their way around this? Not making excuses for them, but it might be a part-explanation.

The credit card issuer doesn't just give those points / cash back from the bottom of their pure heart, most of the time the merchant is made to pay for the customer's perks, at least partially. If a business were to toe a continued profit line, they would either need to pass those costs on to their customers, or not accept cards that cost more / find a way to avoid the premium fee.

Ever wondered why some micro business are not taking credit cards at all, or refuse to take Amex? It's because their merchant fees (last I checked, at / or upwards of 2.65% of the transaction amount) would be eating deep into their end-of-day-take-home amount.

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-17-2024 03:39 PM

That card also gets 5% on food and grocery, so you can work around this by using your card to buy vouchers from 7-11.

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-17-2024 03:13 PM

Maybe I'll try it but there's probably a minimum amount to buy. Never bought before or looked into it. 😞

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-17-2024 03:12 PM

That's unfortunate. 5 years , same amount each month, and PM doesn't categorize as reoccurring. So once 3 ago when I called the bank they offered me $10 for the previous years to make up the 1% difference. I refused and was going to escalate. Never did.

Maybe this weekend I will call again. Hopefully they offer me $20 which I will accept now.🤭

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-17-2024 03:05 PM

@Sansan I have Avion infinite and get points back to but not with PM . But if I was concerned enough about the points I think it’s a worth while work around if it actually works . Maybe I will try and test it because now I’m curious

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-17-2024 03:04 PM

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-17-2024 02:58 PM

Not sure.

My cc is specific for certain purchases such as gas, groceries, reoccurring charges. This card in question gets the full 2% for those charges, koodo and fido been 2 of them. PM on same cc as reoccurring charge, only gets the 1%.

If I shop at Walmart, Ctire, McDonald's, etc, I only get 1% as it's not part of the above criteria.

If I buy the voucher at shell, or petro I assume that I would get the 2% because I'm buying from my category.

But that seems like too much work for me to buy and load, that's what I have the cc for and still feel it should be fixed to the correct category code as confirmed by @Helen_C .

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-17-2024 02:48 PM

@Sansan So do you know if you bought payment vouchers with credit card would you get the rewards that way ?

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-17-2024 02:46 PM

@Helen_C ,

I know exactly how you feel and I'm in your boat. I have my account for 5 years using the same credit card for the 5 years and each month I only get 1%, even though I'm supposed to get 2%. I called the bank and was told it's the way that Public Mobile has set up their merchant category code. And unless PM fix, I will continue to get only 1%.

I'm peeved about this, but was told the same things as indicated by others in this thread.

I don't agree or accept, but no choice. I'm still here, with the same credit years later. I guess it's still better than nothing as some credit cards or debit cards do not offer rewards on purchases.

I do hope this will get fixed one day though. 🤞

- why am i not getting the $1 autopay reward deducted from my monthly payment? in Get Support

- application of reward credit to account, now credit card charged twice for payment in Get Support

- Weird 611 text in Get Support

- how to update my autopay method? in Get Support

- Rewards from referral in Get Support