- Community Home

- Get Support

- Re: Printable Invoice

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Subscribe

- Mute

- Printer Friendly Page

Printable Invoice

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-29-2019 11:38 AM - edited 01-05-2022 03:11 AM

So in the Self Serve portal how do I generate an invoice?

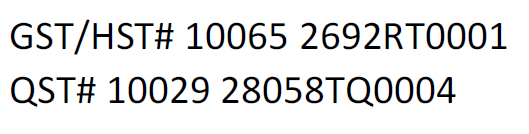

I get charged HST sales tax but there is no place to print an invoice which specifies the tax.

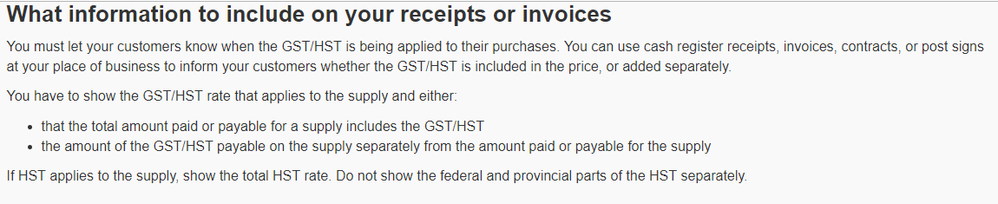

It is illegal in Canada to charge sales tax without issuing a receipt showing the HST number.

So If I pay $40 x3 for 3 accounts I am actually charged $45.20 x3

This means I must legally have an invoice with the tax number so I can claim it back on my business.

Am I missing something or is there no place to print an invoice in Self Serve?

If that is the case someone at Telus better check the provincial tax laws because the tax number must be plainly visible anytime sales tax is charged.

- Labels:

-

My Account

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

12-02-2020 01:02 PM

It would seem that printable invoices have not yet been added as a service. Most unfortunate as it would take little programming to do so.

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-29-2019 01:38 PM

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-29-2019 01:37 PM

I will wait a couple of days to see if a mod wants to escalate it first.

If not I will check into it with Revenue Canada to get their input.

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-29-2019 12:44 PM - edited 01-29-2019 12:45 PM

@KamWest wrote:I've only been here a couple of months and it's not about year end, it is also not about me, it is about what has to be done according to tax laws.

I understand this is a community and not an official place for Telus to respond.

The best way to get this changed is to report it to Revenue Canada to assure all tax laws are properly followed.

In this case, knowing what I have to do to charge sales tax as a business within Canada, Telus is not following the same rules. I run an online store selling 1.5 million per year and I cannot tell my clients they get a receipt if requested. If I charge the sales tax I am obligated to provide the receipt clearly showing my business number/HST/GST number. I also have to show the breakdown of the actual tax/taxes being charged. This is not an option, this is what a business is required to do.

I see I'm not going to get that talking to clients/community members, so my only choice is to inquire with Revenue Canada to investigate this matter for me so I can get an official Telus response.

PS, To anyone asking me to go to another service, you are missing the point, which is Tax laws have to be followed regardless of the level or type of service provided.

@KamWestI look forward to the changes in self serve if you get anywhere. Being able to select the invoice myself would be great. It would reduce not only the customer time of requesting an invoice, but the time it takes for the moderator to read the message and put in the request. So good luck. Heads up to @Alan_K if this is some legal issue to look into.

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-29-2019 12:30 PM

I've only been here a couple of months and it's not about year end, it is also not about me, it is about what has to be done according to tax laws.

I understand this is a community and not an official place for Telus to respond.

The best way to get this changed is to report it to Revenue Canada to assure all tax laws are properly followed.

In this case, knowing what I have to do to charge sales tax as a business within Canada, Telus is not following the same rules. I run an online store selling 1.5 million per year and I cannot tell my clients they get a receipt if requested. If I charge the sales tax I am obligated to provide the receipt clearly showing my business number/HST/GST number. I also have to show the breakdown of the actual tax/taxes being charged. This is not an option, this is what a business is required to do.

I see I'm not going to get that talking to clients/community members, so my only choice is to inquire with Revenue Canada to investigate this matter for me so I can get an official Telus response.

PS, To anyone asking me to go to another service, you are missing the point, which is Tax laws have to be followed regardless of the level or type of service provided.

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-29-2019 12:04 PM - edited 01-29-2019 12:09 PM

@KamWest wrote:Anyone claiming back a sales tax without an invoice specifying those taxes will have to repay on audit.

Telus is not breaking the law, they are not following the tax laws by not supplying that information automatically.

I can see requesting it but 3 times per month is asking a lot for clients to do when it should be automatic in self serve that I can print the page showing the tax clearly charged.

@KamWestIf you feel that they are not following tax laws, contact them, there is nothing we can do (as we are just other customers like you, even if you are right) Contact an official public mobile representative or the tax man and make a formal complaint.

I am supposed to submit my business taxes quarterly, although I don't lol and only do it once per year so not sure why you have to do it every month, considering you have been here for 1 year now, since jan 2018, I would guess you may be exaggerating your monthly need story because this is the first time you are asking about statements and its tax time now. Or you just started a business today then my apologies.

You can request 3 invoices from 3 accounts from 1 message if you put all the correct infor in it. Copy + paste. I would ask myself if the time I spend to send a message is worth the cost savings of public mobile and decide if moving all accounts to Koodo is a better plan. For me, it is not. I am still here.

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-29-2019 12:03 PM

Anyone claiming back a sales tax without an invoice specifying those taxes will have to repay on audit.

Telus is not breaking the law, they are not following the tax laws by not supplying that information automatically.

I can see requesting it but 3 times per month is asking a lot for clients to do when it should be automatic in self serve that I can print the page showing the tax clearly charged.

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-29-2019 12:00 PM

@KamWest wrote:I understand all that and I understand I can record the number but to claim the tax back one must have an invoice specifying the HST/GST number. If Telus charges it they must automatically supply that information each and every time they charge the tax.

Having to request 3 invoices every month is not an option, in self serve they should just be there. Self serve is not even accurate by not showing the taxes.

There is such a thing as no frills and I understand that but I expect a receipt even when I buy at the dollar store and that receipt must have the tax information.

If you feel that they are breaking the law, contact them, there is nothing we can do (as we are just other customers like you, even if you are right) Contact an official public mobile representative or the tax man and make a formal complaint.

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-29-2019 11:57 AM - edited 01-29-2019 11:58 AM

I understand all that and I understand I can record the number but to claim the tax back one must have an invoice specifying the HST/GST number. If Telus charges it they must automatically supply that information each and every time they charge the tax.

Having to request 3 invoices every month is not an option, in self serve they should just be there. Self serve is not even accurate by not showing the taxes.

There is such a thing as no frills and I understand that but I expect a receipt even when I buy at the dollar store and that receipt must have the tax information.

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-29-2019 11:54 AM - edited 01-29-2019 11:55 AM

@KamWest wrote:It might be no frills but it must work within the Canadian Tax laws and you cannot charge sales tax without providing an invoice with the HST/GST number clearly visible.

Telus is not following the tax laws by not supplying each and every customer a receipt with HST/GST number.

That is not about no frills, it is about the right of every Canadian getting charged sales tax.

Just because other pre-paid services do something does not make it right, a receipt must be provided if you are going to charge sales tax.

@KamWest in the payment section they post it

If you feel that they are breaking the law, contact them, there is nothing we (as other customers can do, even if you are right) contact public mobile or the tax man.

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-29-2019 11:53 AM

It might be no frills but it must work within the Canadian Tax laws and you cannot charge sales tax without providing an invoice with the HST/GST number clearly visible.

Telus is not following the tax laws by not supplying each and every customer a receipt with HST/GST number.

That is not about no frills, it is about the right of every Canadian getting charged sales tax.

Just because other pre-paid services do something does not make it right, a receipt must be provided if you are going to charge sales tax.

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-29-2019 11:52 AM

Some people suggest buying vouchers from stores. The receipt you get should have all the info you need.

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-29-2019 11:46 AM

@KamWest wrote:So I have to do that for 3 accounts every single month?

If that is the case then Telus is not following the tax laws, they have to supply each customer a receipt showing their tax number. It has to be done when the tax is charged, this is a big oversight for Telus and if someone reports it to Revenue Canada they can be in big trouble.

Yes, you have to request the monthly statement every month for this no frill mobile service.

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-29-2019 11:44 AM - edited 01-29-2019 11:46 AM

The tax business #'s are shown in the payment area of the self-serve down below in some fine print.

Edit: Public Mobile has been operating for a number of years now. Do you think you're the first one to notice this? I'm sure Telus lawyers have long since figured this out and that what they have is likely sufficient.

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-29-2019 11:44 AM

So I have to do that for 3 accounts every single month?

If that is the case then Telus is not following the tax laws, they have to supply each customer a receipt showing their tax number. It has to be done when the tax is charged, this is a big oversight for Telus and if someone reports it to Revenue Canada they can be in big trouble.

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

01-29-2019 11:39 AM - edited 01-29-2019 11:46 AM

@KamWest wrote:So in the Self Serve portal how do I generate an invoice?

I get charged HST sales tax but there is no place to print an invoice which specifies the tax.

It is illegal in Canada to charge sales tax without issuing a receipt showing the HST number.

So If I pay $40 x3 for 3 accounts I am actually charged $45.20 x3

This means I must legally have an invoice with the tax number so I can claim it back on my business.

Am I missing something or is there no place to print an invoice in Self Serve?

If that is the case someone at Telus better check the provincial tax laws because the tax number must be plainly visible anytime sales tax is charged.

Public Mobile self-serve does not have a user accessible billing statement generator. (Only transaction history for approximately 1 year) Most pre-paid mobile service providers do not give you statements so you will have to contact the moderator team to get your statements. We community helpers are other customers trying to help out with no system access and only a moderator will be able to access your account statements. Click this to send them a message

You do not need to verify your identity by means of the new link to get your statement so include all of the following information below to have your statement e-mailed to you

First name: Last name:

Street address: Suite/Apartment (if applicable):

City: Province: Postal Code:

Customer phone number Account #

Email address (if possible): Requested Month / Period

Amount paid

It can take up to 30 days to get your billing statement so be patient, however last time I requested it I got it in 4 days.