- Community Home

- Get Support

- invoice

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Subscribe

- Mute

- Printer Friendly Page

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

07-28-2020 06:17 PM - edited 01-05-2022 12:35 PM

Hi, I am on autopay, my account was debited today, which is fine, how do I get a receipt or invoice for my business?

thanks

Solved! Go to Solution.

- Labels:

-

Payment

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-07-2021 12:48 AM - edited 06-07-2021 12:49 AM

@barndoor : The rewards will accumulate. Eventually it would save up enough to cover a term. "Free".

Although this is unofficial so subject to change at any time without notice.

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-07-2021 12:31 AM

@Anonymous wrote:@boom12admin : Here's a strategy for you:

1. buy $40 of vouchers - get receipt showing all the taxes and vendor GST #

2. redeem it into your account.

3. Your next renewal will take $40 from that balance leaving you, currently, with all things remaining equal, with an extra $7 balance.

4. after that renewal, buy more vouchers

5. redeem

6. the next renewal you'll end up with $14 extra

7. renew again $21, renew again $28, renew again $35

8. This next renewal will convert those rewards into your balance and you'll have $42 to pay your $40 plan leaving you with $2.

9. Do it all again.

This way, you get the full taxes for ITC's and the GST # all for your records and you get a "free" month every 6 months. No asking for receipts and waiting for them. You have all you need.

Then your loyalty reward will increase. Or you'll get more referrals. Adjust the time lag for future free months accordingly.

How does he get a "free" month every 6 months ? I see him having a month where he doesn't need to buy vouchers but it sure wasn't "free " ... I assume is his case it will be more apt to be $100 vouchers but same principle ?

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-07-2021 12:17 AM - edited 06-07-2021 12:18 AM

@barndoor wrote:

@softech wrote:

of course, someone can still make a fight on this.. maybe they will win after some serious audit.. but whoever make this happens will certainly not a hero

At least not with those getting rewards here . LOL

I don't expect the discounts are taxable in this case due to the way they are applied ... I would question it a bit because it seems to me the rewards you are getting are for services rendered here on behalf of PM but I'm sure the accountants have a way around that .

Rewards aren't credited after you've been charged for the plan, but rather before. This means that they end up reducing the amount charged, and you only end up paying tax on the lower amount.

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-07-2021 12:13 AM

@softech wrote:

of course, someone can still make a fight on this.. maybe they will win after some serious audit.. but whoever make this happens will certainly not a hero

At least not with those getting rewards here . LOL

I don't expect the discounts are taxable in this case due to the way they are applied ... I would question it a bit because it seems to me the rewards you are getting are for services rendered here on behalf of PM but I'm sure the accountants have a way around that .

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-06-2021 10:13 PM

Well since you asked what my nearly 12,000 posts has saved me? Since switching my two phone accounts from telus and freedom and the bf's from fido I save from what I was paying before $2217.60 a year. In two months I will have been here two years...that's $4435.20. With what I make in credit as of now and as long as public mobile is in business....

I WILL NEVER HAVE ANOTHER PHONE BILL FOR THE REST OF MY LIFETIME.

But as anyone will tell you we are not here for the money we are here because we like to volunteer our time to help people. I am the first person to advocate for the little guy.....you are just whining misguidedly about tax law. Go ahead take up the cause and if you win and prove your point I'll eat any one of my many hats that you choose.....but I'm putting my money on the telus team of tax lawyers that they know what they are doing since purchasing pm back in 2014.

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-06-2021 07:40 PM - edited 06-06-2021 07:41 PM

All I have to say is, I think with the amount I paid, I am happy with the service. I didn't pay a premium so I didn't expect premium service.

Also, while the mod might reply late, the knowledgeable members here really devoted the time here to help others.. they might even be better than paid PM staff .

(i don't see any cartoon characters here at all)

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-06-2021 07:30 PM

@barndoor : It's a fine suggestion. Nobody denies that. How much do you want to pay for it? Do you like the low rates with the rewards around here? I do. I'd rather the glitches and foibles around here than they spending money on these kinds of things.

There aren't many new suggestions to be had. These things have been bandied about since the beginning. Things move at a snails pace around here. So the resources needed to implement the suggestion opposed to the cost of the time for an employee to manually supply it to the customer. Dunno.

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-06-2021 07:27 PM - edited 06-06-2021 07:28 PM

I don't understand why on one hand PM has giveaways , and discounts and special plans , and provide real time help for new customers ...in order to get new business and then they just defecate on the old customers with the likes of simon , having to chase down moderators if you need one for a special request like this and deal with the opinionated customer service staff here .

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-06-2021 07:21 PM

Come on man ... this is a telcom company , that should tell you how far you're going to get by pushing .

As far as the response from the PM minions here ... really ? I'm really starting to question the employment status with PM of some of you .

What is wrong with putting an option on the the account page of whether the customer needs a monthly /quarterly or annual invoice ... they would rather lose the approximately $150 a month of business that @boom12admin provides per month over something so simple ??

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-06-2021 07:17 PM

@boom12admin : Here's a strategy for you:

1. buy $40 of vouchers - get receipt showing all the taxes and vendor GST #

2. redeem it into your account.

3. Your next renewal will take $40 from that balance leaving you, currently, with all things remaining equal, with an extra $7 balance.

4. after that renewal, buy more vouchers

5. redeem

6. the next renewal you'll end up with $14 extra

7. renew again $21, renew again $28, renew again $35

8. This next renewal will convert those rewards into your balance and you'll have $42 to pay your $40 plan leaving you with $2.

9. Do it all again.

This way, you get the full taxes for ITC's and the GST # all for your records and you get a "free" month every 6 months. No asking for receipts and waiting for them. You have all you need.

Then your loyalty reward will increase. Or you'll get more referrals. Adjust the time lag for future free months accordingly.

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-06-2021 06:52 PM - edited 06-06-2021 06:56 PM

@boom12admin wrote:It is illegal to tax before the discount is applied.

They aren't doing anything special. This isn't a "kindergarten mistake" it is just not caring. The legal team isn't used to follow the rules, haha, it is used to determine how far they can be pushed.

That I don't agree

if Walmart has a 10% discount on an item and they charge you tax AFTER the discount.

if you have a $10 gift certificate from a vendor, you use it, you still got taxed on the original price, not after the $10 off.. cos the $10 is a different kind of "method of payment", not a discount.

PM does have a legal reason to tax after Community Reward , Autopay Reward and Loyalty reward .

to be serious, these kind of reward discount, some businesses tax after discount applied, some tax at full value. Maybe CRA has guidelines but I don't see all businesses doing the same way. Of course each would have a reason for why or why not and it will take accountants, lawyers years of fight with CRA to see if the practice was correct or not

of course, someone can still make a fight on this.. maybe they will win after some serious audit.. but whoever make this happens will certainly not a hero

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-06-2021 06:49 PM

@boom12admin wrote:It is illegal to tax before the discount is applied.

They aren't doing anything special. This isn't a "kindergarten mistake" it is just not caring. The legal team isn't used to follow the rules, haha, it is used to determine how far they can be pushed.

Again I don't care about ITC's. And for you to be on this crusade that could impact everybody else negatively would not be at all appreciated by all the other customers here.

I would maintain that the Telus legal department knows full well how far they can be pushed and that what they provide here is legally sufficient for the likely vast majority of customers. For the likely far fewer of those that just gotta have it all...well they can ask and they shall receive.

I'm no federal tax lawyer but I seem to think taxes are to be charged on the full value of a good. Rewards aren't discounts. You see the full amount of the thing you're buying. Then you happen to get a few dollars off of that that looks a lot like money. Then you get taxed on the net amount of _new_ money you put in.

But we certainly don't need to get into those details as I have little certainty of it all.

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-06-2021 06:40 PM

It is illegal to tax before the discount is applied.

They aren't doing anything special. This isn't a "kindergarten mistake" it is just not caring. The legal team isn't used to follow the rules, haha, it is used to determine how far they can be pushed.

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-06-2021 06:40 PM

@boom12admin go ahead and open ticket with Mod... and bring us back the good news. If they need member names requiring that on his/her account, include me. 🙂

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-06-2021 06:37 PM - edited 06-06-2021 06:40 PM

The Canada Revenue Agency makes up the rules not me. I am not a moron, I know that the tax is the difference. I asked them, they provided the information I shared. I am not offering my opinion (or trying to woo people with sharp wit and basic math skills!). I am sharing official information from the official source.

If only you were as good at reading as you were at simple math:

"A registrant should be aware that a monthly credit-card statement does not constitute sufficient documentary evidence to claim an ITC."

Here's some good math for you: do this one in your head - how much is your time worth? How many dollars did you save by doing Telus' customer service for them in the almost 12000 posts you've made here lol

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-06-2021 06:31 PM - edited 06-06-2021 06:34 PM

"a bunch of people defending Public Mobile ". @boom12admin , I know you are not talking about me... remember we are on the same side?

Telus is no small business.. PM has been running for years. I doubt business with such a big legal team behind would make a "kindergarten" mistake.

Yes, big businesses do make mistakes occasionally. I see those class action giving free money every once in a while (btw, side topic, everyone claim your Windows and Office money for the money you deserve from the recent class action?) , but those class action require a big legal team for years of fighting . I am not in the field, and I am not interested to give in couple years of my life on such an important topic to my mobile service.

BTW, don't get it wrong, I encourage you 100% to check with mod.. ask and press Telus for a solution. We are not going to settle for anything less ..

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-06-2021 06:28 PM

@boom12admin : This is the part of careful what you wish for that I mentioned. Those $7 in rewards see no taxes. So you have autopay make up the difference. In your example, that's $33 plus your 15% taxes that you get charged to the autopay registered payment card.

If you make a manual payment in the payment system, you'll see the taxes to be paid on the amount you entered.

Like I said, law or no law, I don't care...because I'm not in a situation to need to use ITC's.

Like I said, this place charges tax on the new, real money being added...not rewards.

Good luck in your crusade. We'll all be mightily peeved at you for forcing their hand to make everything all "legal".

Maybe a business needs to use a post-paid provider that will send you a bill with all the proper legal information required. Do you really think this large corporation wouldn't be perfectly legally aware of what they can get away with for their little low-budget outfit?

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-06-2021 06:21 PM

This is a prepaid provider. All prepaid providers work the same way if you are unable to do the math to do your books each month before you recieve an official reciept/invoice from public mobile or you are unable to pay a manual top up take a screenshot of the taxes being remitted with your payment or co-orelate your credit card charges to your transaction history then maybe public mobile isn't for you.

Choose a post paid provider who is required by law to provide you with an invoice each month that clearly shows you the taxes being remited each month after you pay the bill after you have used their services. You will not recieve their invoice any faster then if you requested one monthly ( every 30 days) from pm after you prepay for your services and wait the 3 to 4 weeks to recieve it.

You know the math is very simple....for example if you live in bc and your plan amount is $40. The gst is 5% ( $40×5%=$2) the pst is 7% ($40×7%=$2.80) $2+$2.80=$4.80 $40+$4.80=$44.80 See simple!

But of course if you have rewards like the $2 autopay reward then the math is a little more difficult. Its important to remember you are not charged the tax on the reward amount like other providers do with discounts on occasion. So instead the math would be as follows: $40-$2=$38 ($38×5%=$1.90 gst) and ($38×7%=$2.66 pst) $1.90+$2.66=$4.56 $38+$4.56=$42.56

See it's easy....I didn't even need a calculator!😃

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-06-2021 06:17 PM

This is my last reply in this thread. It is just a bunch of people defending Public Mobile - even when they claim to agree.

I asked the Canada Revenue Agency and they sent me the links I shared earlier and told me that Public Mobile has to show me how much tax they charged me each month. They don't.

If you want to continue arguing about it to defend Telus, call the Canada Revenue Agency yourselves.

Anyone who thinks people should have to request a receipt for something they're paying for is unreasonable. Receipts aren't a novelty, they aren't optional. It is the proof of the transaction. These things exist for a reason. Telus can and should provide this.

Imagine if you went to Wal-Mart, bought something, didn't get a receipt, were told you had to request it separately and wait a month for it.

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-06-2021 06:00 PM

@boom12admin Open a ticket with Mod and voice your concern.

As I mentioned, the transaction history is not really invoice.

Many members was puzzled with the poor design too. I agree that it will be easier if they show the tax charged there to ease confusion. I am definitely on your side and would like to see that implemented.

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-06-2021 05:56 PM

You are really committed to picking the giant corporation over the little guy here.

Businesses must follow laws. The law says you have to show people what you charge them, charge tax on the sale, and show the tax separately.

A one-month wait for an invoice is not reasonable. The law requires you to show people. This crap about invoice versus transaction list doesn't hold water. Telus can automatically provide the correct information. They are a mega corporation with tonnes of money. It doesn't even cost more to do it. If they can charge my card, they can issue a receipt. Period.

As you can see here, they can't even provide a receipt or accounting that aligns with the charges to the cards.

For small business owners, GST/HST is remitted monthly, quarterly, or annually - it depends on the business. I can't wait and ask for a year's worth. I require a monthly invoice to do my books. This is costing me around $200 per year.

There is NO reason for them to exclude the taxes they're charging, they are required by law to show the tax charged.

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-06-2021 05:39 PM

@boom12admin wrote:I signed up for low prices because it is self-serve.

There's no such thing as a "place more for consumers who don't care about ITC's and invoices" ... it is the law. Period.

If my small business can follow these rules so can Telus.

You have to show people how much tax you are charging and what you are charging it on.

Not being able to claim the ITCs costs me $207 per year.

I agree not clearly showing the tax is unsatisfactory, but again, PM does nothing wrong. At the end of the end, they charged you the correct tax

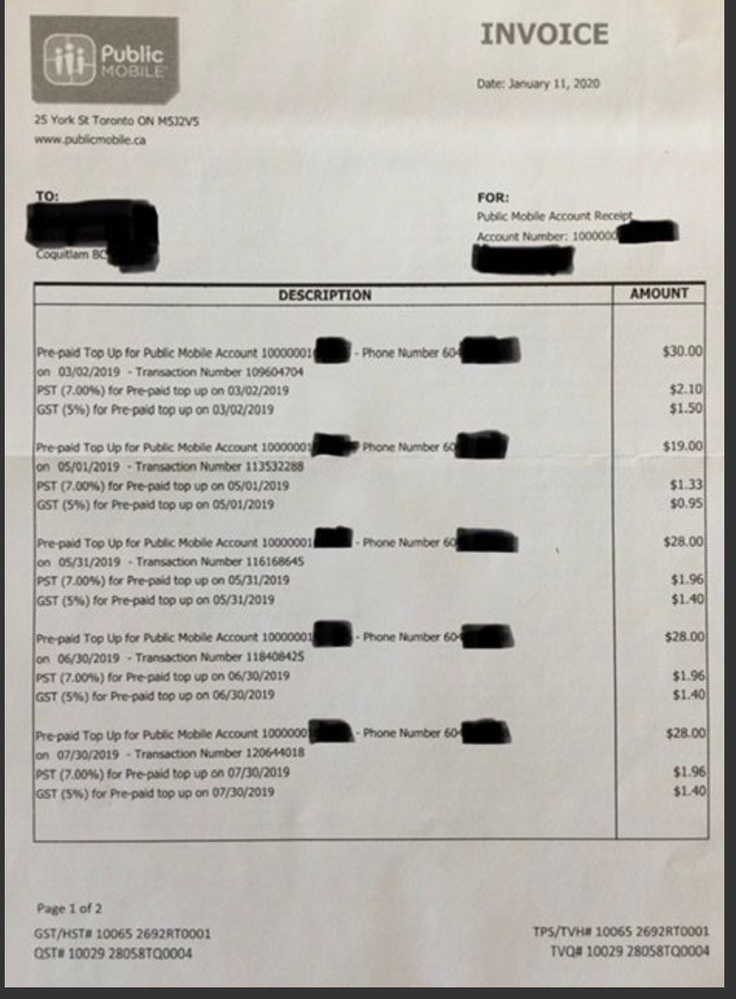

For claiming proper tax, you can request an official invoice, this is an experience from member here:

Many members contacted mod and did get the invoice with tax clearly showing on the invoice. Hope this helps.

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-06-2021 05:38 PM

When you use autopay you may request an invoice to show you the taxes paid on your automatic payments that fufills the CRA requirements.

This ia an example of what you will recieve....

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-06-2021 05:36 PM

I signed up for low prices because it is self-serve.

There's no such thing as a "place more for consumers who don't care about ITC's and invoices" ... it is the law. Period.

If my small business can follow these rules so can Telus.

You have to show people how much tax you are charging and what you are charging it on.

Not being able to claim the ITCs costs me $207 per year.

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-06-2021 05:31 PM - edited 06-06-2021 05:42 PM

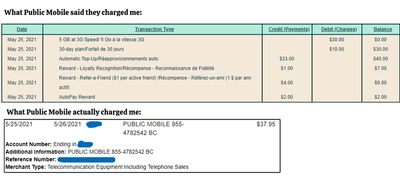

@boom12admin wrote:"Also, you have to either show the amount paid or payable for the supply separately from the amount of GST/HST payable on the supply or show that the total amount paid or payable for a supply includes the GST/HST."

That means: must show how much GST/HST is charged. Can you show me where Public Mobile shows me what I pay for and how much GST/HST is charged on it each month?

I must be missing it because it literally shows no tax charged in the transaction list which is, frankly, false. Tax is being charged, as required by law but it is not being reported.

The "transaction" listing fails to show what the amount charged to my card is. That is unlawful.

Now sure why it said it is unlawful. It will be unlawful for PM if they do not to charge you the tax

The transaction history is not an invoice. So, PM does have the reason not to show it there.

You can request an official invoice from PM if you want to see all the tax amounts charged. I You can request that with Mod and they will send you in around a month. Since it takes time, you might want to request invoice for the past 6 months and not asking one month at a time.

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-06-2021 05:23 PM

"Also, you have to either show the amount paid or payable for the supply separately from the amount of GST/HST payable on the supply or show that the total amount paid or payable for a supply includes the GST/HST."

That means: must show how much GST/HST is charged. Can you show me where Public Mobile shows me what I pay for and how much GST/HST is charged on it each month?

I must be missing it because it literally shows no tax charged in the transaction list which is, frankly, false. Tax is being charged, as required by law but it is not being reported.

The "transaction" listing fails to show what the amount charged to my card is. That is unlawful.

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-06-2021 01:02 PM

@boom12admin : And I'll just add a veiled "careful what you wish for".

This place is really more for consumers who don't care about ITC's and invoices etc. They just want their service to keep going.

The taxes are charged on new, real money coming in.

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-06-2021 12:58 PM

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-06-2021 12:54 PM - edited 06-06-2021 12:54 PM

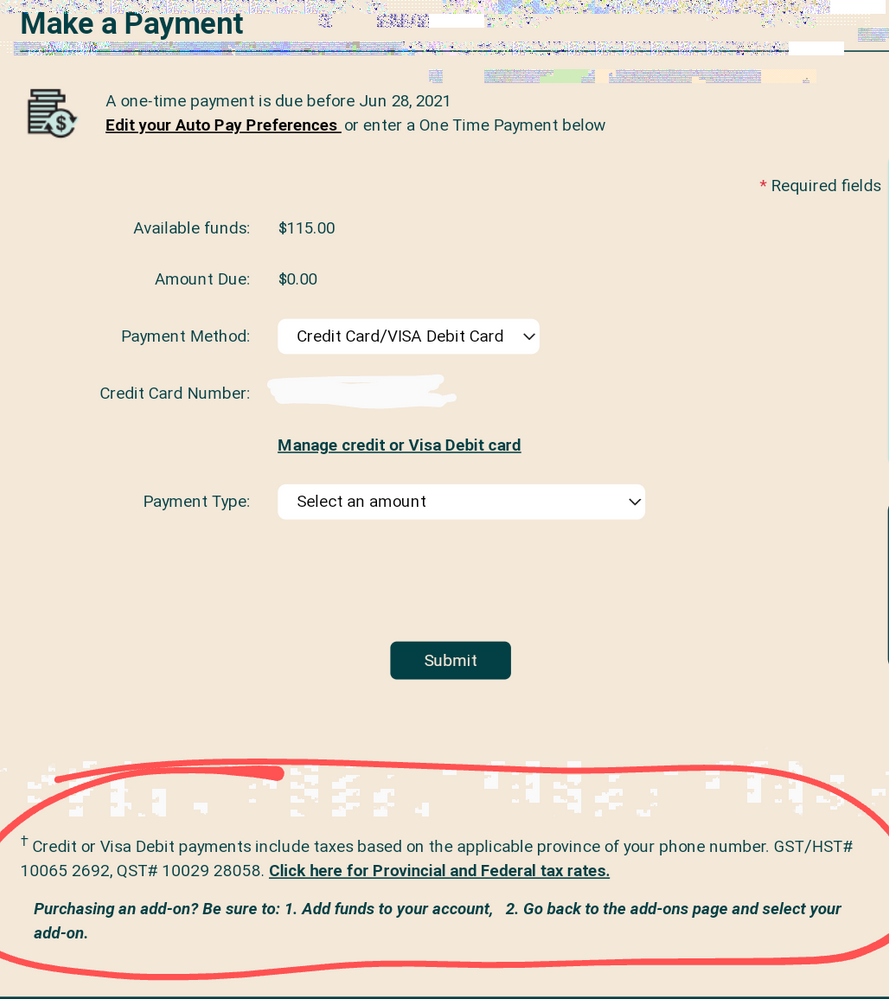

The pst/gst/hst notification is posted in your account at the bottom of the payment page. All manual top ups are non refundable as per pm's terms of service thus the tax is charged at the time the top up payment is made as per CRA requirements and in accordance of the law.

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

06-06-2021 12:42 PM

Everyone here is great at sharing Public Mobile's policies. However, it is unlawful to charge GST/HST and not meet the Canada Revenue Agencies requirements for charging/collecting/receipting.

"Receipts and invoices

Information to include on your receipts or invoices

You must let your customers know if the GST/HST is being applied to their purchases. You can use cash register receipts, invoices, contracts, or post signs at your place of business to inform your customers whether the GST/HST is included in the price, or added separately. You have to show the GST/HST rate that applies to the supply. Also, you have to either show the amount paid or payable for the supply separately from the amount of GST/HST payable on the supply or show that the total amount paid or payable for a supply includes the GST/HST."

Further, adding $20 to your account BEFORE a purchase is a DEPOSIT:

"Deposits

Do not collect the GST/HST when a customer gives you a deposit towards a taxable purchase. Collect the GST/HST on the deposit when you apply it to the purchase price.

If the customer does not make the purchase and loses the deposit, the forfeited deposit is subject to the GST/HST. If the customer is a GST/HST registrant, the customer can claim an ITC for the GST/HST paid on the forfeited deposit."

https://www.canada.ca/en/revenue-agency/services/tax/businesses/topics/gst-hst-businesses/charge-col...