- Community Home

- Get Support

- Re: Charged BC tax in alberta

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Subscribe

- Mute

- Printer Friendly Page

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-05-2019 04:26 PM - edited 01-05-2022 07:52 AM

I am charged 12% tax instead of 5% when activating my SIM.

Please help me with this.

Solved! Go to Solution.

- Labels:

-

Joining Public

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-06-2019 04:11 AM

It seems to me if you wanted to straight up save 7-10 % off your bill every month you could just change to an Alberta number. If you are not porting in a number and are going to get one of the new area codes anyways why not save a little more money?

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-06-2019 12:45 AM

@Jasgrewal If most of your calls are from BC I can see you keeping your BC number as your outbound calls are Canada wide and your callers, call free. Unless your Calgary friends and associates have Canada Wide calling, they won’t appreciate having to call you Long Distance. But darn your not “in” Calgary unless you have a 403 number. Another consideration.....2 $15 plan.

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-06-2019 12:28 AM

@88cranston wrote:

@Jasgrewal wrote:Hi,

I have number of BC as I ported from rogers.

So, Can i get a new Calgary number now starting 403?

And, then I suppose my tax rate will change to 5%.

Keep your BC number if you like. Buy top up vouchers in Alberta.

Or, yes, you can change your number to an Alberta number through your account, free. The question is, will PM offer you a 403 number?

PM is still offering 403 number for southern Alberta small town and cities - NOT in Calgary.

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-06-2019 12:23 AM

@popping wrote:

@computergeek541 wrote:

@Dunkman wrote:You can get a Calgary number. Not sure which area codes are availble for new Public mobile numbers for Calgary. Then your future bills will be charged 5%.

This is true for payments submitted through Public Mobile self serve using a credit or Visa Debit card. Vouchers purchased at retail locations will be taxed at a rate applicable to where it is purchased.

Yes. I activated 2 PM accounts for my sister living in Montreal a month ago. She eTransfers fund to me to purchase topup voucher in AB and save 10% tax.

Now that is sisterly love and darn thrifty! I lived in Calgary for 5 years. The days of no sales tax may soon be over. If they have to tighten the budget more...it could happen. But will be last step as it is political suicide.

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-06-2019 12:17 AM

@computergeek541 wrote:

@Dunkman wrote:You can get a Calgary number. Not sure which area codes are availble for new Public mobile numbers for Calgary. Then your future bills will be charged 5%.

This is true for payments submitted through Public Mobile self serve using a credit or Visa Debit card. Vouchers purchased at retail locations will be taxed at a rate applicable to where it is purchased.

Yes. I activated 2 PM accounts for my sister living in Montreal a month ago. She eTransfers fund to me to purchase topup voucher in AB and save 10% tax.

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-06-2019 12:07 AM

@Jasgrewal wrote:Hi,

I have number of BC as I ported from rogers.

So, Can i get a new Calgary number now starting 403?

And, then I suppose my tax rate will change to 5%.

Keep your BC number if you like. Buy top up vouchers in Alberta.

Or, yes, you can change your number to an Alberta number through your account, free. The question is, will PM offer you a 403 number?

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-05-2019 11:51 PM - edited 11-05-2019 11:52 PM

@Dunkman wrote:You can get a Calgary number. Not sure which area codes are availble for new Public mobile numbers for Calgary. Then your future bills will be charged 5%.

This is true for payments submitted through Public Mobile self serve using a credit or Visa Debit card. Vouchers purchased at retail locations will be taxed at a rate applicable to where it is purchased.

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-05-2019 07:12 PM - edited 11-05-2019 07:18 PM

@Dunkman wrote:

@Jasgrewal wrote:Hi,

I have number of BC as I ported from rogers.

So, Can i get a new Calgary number now starting 403?

And, then I suppose my tax rate will change to 5%.

You can get a Calgary number. Not sure which area codes are availble for new Public mobile numbers for Calgary. Then your future bills will be charged 5%.

My son has a AB number and is living in YVR paying GST only.

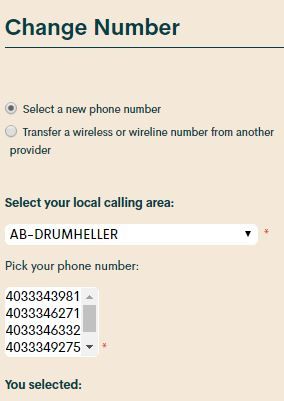

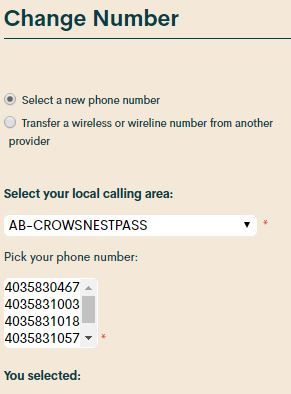

PM is giving out 587 area code number for Calgary. But 403 number for Drumheller.

Select [Plan and Add-Ons]--> [Change Phone Number] --> [Select a new phone number]

and look for AB-DRUMHELLER phone number.

AB-CROWSNESTPASS has 403 number too.

Just play with it and look for the southern Alberta town/city which you like.

If you have a Canada wide calling plan, you do not have long distance charge. Your callers will be charged long distance when they call you if they do not have Canada wide calling plan.

Please note that you are allowed to change number once every 30 days. But you can change your number by porting number from other provider as oftern as your like.

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-05-2019 06:26 PM

@Jasgrewal wrote:Hi,

I have number of BC as I ported from rogers.

So, Can i get a new Calgary number now starting 403?

And, then I suppose my tax rate will change to 5%.

You can get a Calgary number. Not sure which area codes are availble for new Public mobile numbers for Calgary. Then your future bills will be charged 5%.

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-05-2019 06:09 PM

Hi,

I have number of BC as I ported from rogers.

So, Can i get a new Calgary number now starting 403?

And, then I suppose my tax rate will change to 5%.

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-05-2019 04:52 PM

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-05-2019 04:47 PM

@will13am is completely correct in the matter ! Great job 😄

- Mark as New

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

11-05-2019 04:29 PM

@Jasgrewal, sales tax is assessed based on the area code of the number that you selected for your account. So, if you selected a BC area code, you will be assessed tax as if you are a BC resident even if you reside in AB. This is how the government decided taxes will be calculated.